As the Federal Reserve in the United States sharply raised interest rates, the global financial markets were in turmoil. Several large banks collapsed, and funds flowed heavily into safe-haven assets. Gold became highly sought-after and approached historic highs per ounce. As an investment with considerable potential for appreciation, are you interested in learning more about gold?

Investors who are interested in gold can choose to purchase physical gold or explore alternatives such as gold ETF and paper gold.

Will Gold Prices Continue to Soar in 2023?

As we step into 2023, the tensions between Russia and Ukraine continue to escalate. Shortly thereafter, several major banks such as Silicon Valley Bank, First Republic Bank, Signature Bank, and Credit Suisse suddenly collapsed, causing the market’s risk aversion sentiment to soar. A large number of funds poured into the safe-haven gold market, driving the spot gold price close to $2,000 per ounce, approaching the historical high of $2,070 per ounce.

Currently, the rise in gold prices is attributed to the weakening of the US dollar and the increasing pressure on the global banking system, leading to a large influx of funds into safe-haven assets. This trend may continue until the end of March 2023.

However, if investor confidence increases, it may reverse the current situation. The turning point may depend on the Federal Reserve’s interest rate meeting on March 23. if dovish sentiment prevails, gold will likely benefit, while a neutral or hawkish stance may cause gold prices to fall.

While gold can offer a stable store of value in uncertain times, it is crucial to remain vigilant about the market’s ever-changing landscape and the potential reversals in trends.

Physical gold: proper maintenance is required to preserve the value

Physical gold comes in various forms such as gold nuggets, gold bars and jewelries/accessories. One advantage of physical gold investment over other options is the fact that investors get to own something that they can see and touch.

Investors from the older generation like to visit gold shops to purchase or make accessories for the purpose of investment or value preservation, however purchasing gold jewelries or accessories typically include additional fees such as design, making and wastage charges.

One convenient way to invest in physical gold is to invest directly through retail banks. Many banks in Hong Kong such as Bank of China, Hang Seng Bank, Wing Lung Bank, Shanghai Commercial Bank etc. offer physical gold trading service. However, investors should be mindful that not all bank branches stock gold so it would be best to make a phone call before making a visit.

Physical gold also requires storage and proper maintenance as any damage would affect the gold’s value. Investors may explore vault service for storage and safety.

Paper gold: low barrier to entry but be cautious when selecting service provider

Gold passbook account or paper gold is an alternative for investors who do not wish to deal with physical assets. While investors can trade gold on a passbook account, there is no actual buying or selling of physical gold – this also means physical gold can not be withdrawn from the account either. The passbook accounts only record gold deposits and trades, hence the investors will not be getting any interest income from the bank. The only way to make money from paper gold investment is through price appreciation as the price of paper gold fluctuates with the gold market. One other benefit of paper gold investment is its low barrier to entry as the minimum transaction amount can be very low.

The value of paper gold depends entirely on the gold passbook account, this makes the credibility of financial institutions or banks who offer this service extremely important. For example, in an unlikely event of bankruptcy, the value of paper gold held in the passbook account may return to nothing.

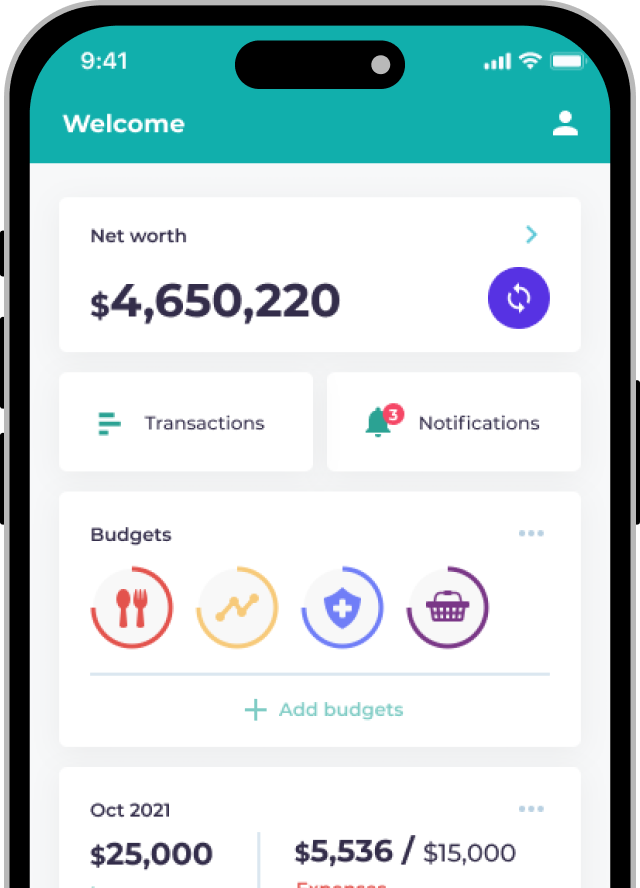

Gold ETF: Low barrier to entry, high transparency and liquidity, watch out for management fee

Investors who are interested in both gold and the stock market can choose to either invest in gold related companies or explore gold ETFs. Gold ETFs are gold related funds which offer high transparency and liquidity when it comes to gold investment. Gold ETFs that are currently available on the Hong Kong Stock Exchange include SPDR Gold ETF (2840), Value Gold ETF (3081) and Hang Seng RMB Gold ETF (83168). Gold ETFs are backed by gold commodity, this means when an investor purchases gold ETF, the issuer will buy physical gold of corresponding value and place it in a high security vault.

Apart from being listed in Hong Kong, SPDR Gold ETF is also listed in the U.S. and Japan which are considered more international markets. Value Gold ETF is issued by a Hong Kong asset management company called Value Partners. The Hang Seng RMB Gold ETF is issued by Hang Seng Investment Management, however this requires RMB for trading.

According to the price on 20th March 2023, Value Gold ETF costs about HK$43.32per share, and 1 lot consists of 100 shares – which means HK$4,332 per lot. On the U.S. exchange, GLD ETF share price in the same period is US$183.84 per share with no lot restriction. With gold ETFs, casual or new retail investors can participate in the gold market with funds as low as HK$1,000. One thing to note however is ETFs generally have management fees, but they typically do not exceed 1%.

Participation in the stock market always involves risk. Gold ETFs in Hong Kong do not have hedging mechanisms so whenever gold price drops, the price of gold ETFs will also follow.

Explore overseas Gold ETFs

While there may only be a few gold ETFs in Hong Kong, the concept of gold backed ETFs have been popular in the U.S. and Europe for the past decade. There are close to 100 gold ETFs registered around the world and Hong Kong investors can easily explore them through some of the local and international brokerage platforms.

Free stock offers from brokerages

Many investors invest in gold ETFs through the Hong Kong or U.S. stock exchanges to take advantage of high liquidity. The following are some of the popular welcome offers from stock brokerages:

Recommended Readings

- Welcome Offer Comparison: Get Free Blue-Chip Stocks With New Investment Accounts

- Investment Strategy Guide to building a diversified portfolio

- Valuable Capital Review: Commission-free HK stock trading, free real-time quotes

- Futu Securities Review

- Saxo Bank Review: A Simple Offshore Banking & Trading Solution for Hong Kongers

Important information:

Investment involves risks. This information is intended to be educational and is not tailored to the investment needs of any specific investor. This information does not constitute investment advice and should not be used as the basis for any investment decision nor should it be treated as a recommendation for any investment or action. Past performance is no guarantee of future results. The value of investments and the income from them can go down as well as up, so you may not get back what you invest.