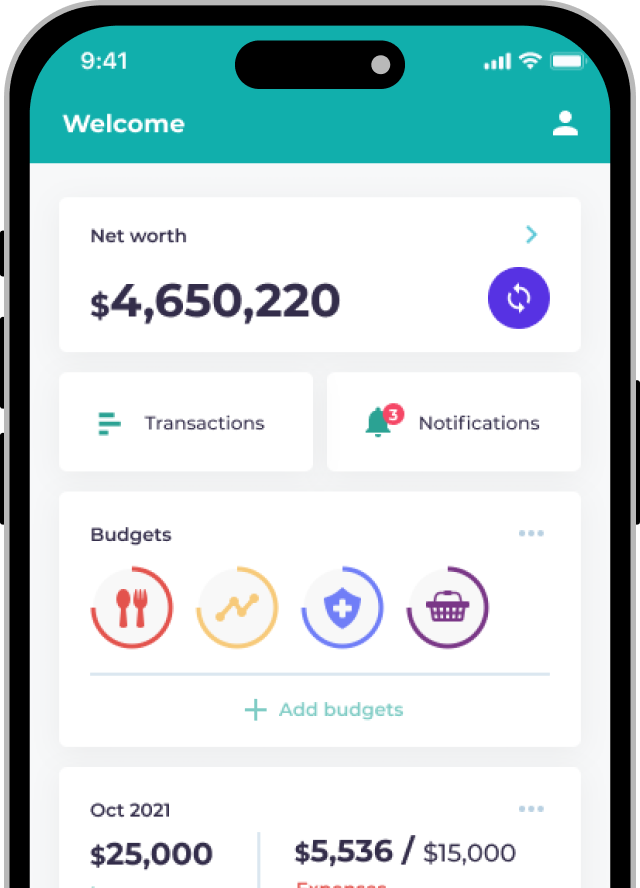

Due to heated competition between investment service providers, various securities brokers are competing for new customers. In recent months, securities brokers are going above and beyond competing with services, and account opening welcome offers are becoming a norm among securities brokers in Hong Kong.

Consumers are opening securities accounts for investment, and no welcome offer would prove to be more attractive than having blue-chip stocks in the newly opened account, for free!

Welcome offers from providers like Futu Securities, SoFi HK (Formerly 8 Securities), uSMART Securities and 9F Securities are currently among the most attractive in the market. Find out how you can get free stocks in your new securities account below:

Free stocks are especially great for new investors

From experienced investors’ perspective, receiving a few free shares may not have any impact on their overall portfolio, however this may not be the case for new investors. According to a survey done by Hong Kong Investor Education Center, over 62% of their survey respondents want to increase their wealth through investment, but they are afraid of losing money.

First time experiences are often scary, and they intensify when money is at stake. New investors may be concerned about making the right investment choice or they feel unfamiliar with the buying/selling process of investment which ultimately lead to the fear of losing money.

Free stocks solve this problem for new investors by giving them stocks to manage for free as soon as they open an account. They can experience the up and down of investment, then try selling off stocks for profit before they invest their own money.

Furthermore, securities firms like Futu and 9F do not charge any custodian fee so new investors can take their time and experience investment process free of charge. Since welcome offers typically give out popular blue-chip shares, new investors can also use this chance to get to know these companies and their performance before consider investing their own money.

Odd lots

Most welcome offers will give out 1 or 2 share(s), which will be considered an odd lot because it amounts to less than 1 single board lot (For example 1 single HSBC lot size contains 400 shares). According to HKEX, odd lots are not accepted by the Exchange’s trading system for auto-matching, but there is a special lot market in the system for odd lots trading. In general, share prices of odd lots are slightly lower than that of the same security in the board lot market due to their lower liquidity.

Given the welcome offer’s odd lots are free in the first place and their selling price could increase in the future, a slight discount in share price should not be a big consideration. Although odd lots are typically eligible for dividend, if the number of shares is too small, any dividend could be offset by handling or platform fee.

The concept of odd lot does not apply if you receive U.S. stock as part of the welcome offer since the lot system is unique to the Hong Kong market. U.S. stocks are traded on per share basis so welcome offer shares will have the same liquidity as any other shares.

Welcome offer comparison and more details

Securities firms in Hong Kong are offering a wide range of welcome offers to new customers. Find out more and compare them below:

Recommended Readings

- Investment Strategy Guide to building a diversified portfolio

- Valuable Capital Review: Commission-free HK stock trading, free real-time quotes

- Futu Securities Review

- Saxo Bank Review: A Simple Offshore Banking & Trading Solution for Hong Kongers

Important information:

Investment involves risks. This information is intended to be educational and is not tailored to the investment needs of any specific investor. This information does not constitute investment advice and should not be used as the basis for any investment decision nor should it be treated as a recommendation for any investment or action. Past performance is no guarantee of future results. The value of investments and the income from them can go down as well as up, so you may not get back what you invest.