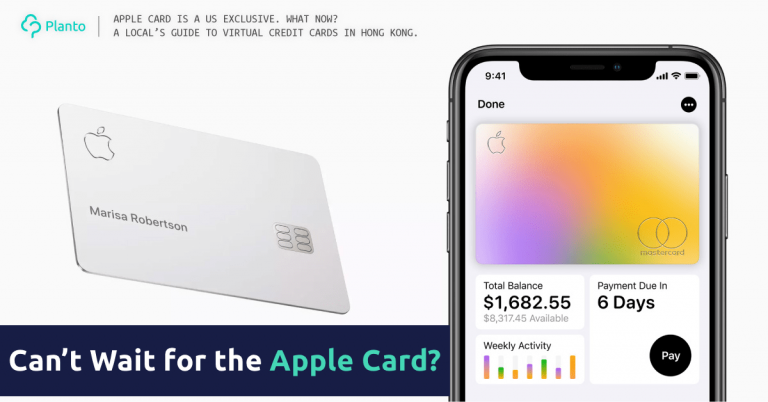

The Apple Card is out in the United States in both physical and virtual versions.

The Apple Card trademark was recently registered in Hong Kong, suggesting the eventual launch of the much-hyped credit card in the area. But there’s no reason to wait if all you want is a virtual credit card! With the rise of virtual banks and the added benefits in security and convenience, virtual credit cards are becoming the new norm.

So what's so great about this new fintech product? We've done the research for you so you don't have to!

| Physical Credit Card | Virtual Credit Card | |

|---|---|---|

| Application Procedure | Online / Walk-in | Online |

| Transaction Modes | Swipe / Contactless / Online | Contactless / Online |

| Security | Sensitive information embossed on card surface | Information stored and encrypted in phone |

| Cashback and Offers | Generally available. Depends on individual institutions | Generally available. Depends on individual institutions |

Physical Cards Replaced With Virtual Cards In Your Phone

As the name suggests, a virtual credit card lacks a physical presence that is the plastic currently sitting in your wallet. Instead, all vital information of a credit card is stored in your phone. With a phone that supports NFC (pretty much every smartphone post-iPhone 6), a virtual credit card functions identically to its physical counterpart except that you can’t swipe it. Rest assured that it is accepted in both physical (via contactless payment) and digital marketplaces, with cashback and offers from card issuers.

But if they do the same thing, why bother switching at all?

Card Info Concealed For Safer Transactions

With a physical credit card, your full name, card number, expiry date and security code are exposed every time you take your card out – potentially a security risk if you're handing your card to a shop attendant!

On the other hand, a virtual credit card’s information is for your eyes only. A physical transaction with a virtual credit card involves simply tapping your phone on the compatible card reader. No visible information, nothing to leak. For added security, some cards such as Apple Card even have the option to generate a one-time card number and security code, eliminating the risk of information being compromised.

For additional security, users can activate passcode and biometric authentication (e.g. fingerprint, facial and iris recognition) to stop malicious attempts even when the phone is lost. Reporting a lost virtual credit card is also easier than reporting a physical credit card.

Faster Service, Purely Online

Virtual credit cards are open for application, renewal and reporting online, but so are most physical cards. The biggest difference is how long it takes to receive the new card: a physical credit card arrives at your mailbox within a few days to a month; a virtual credit card is instantly available upon approval.

On the other hand, since the virtual card itself cannot be swiped, sometimes you will have to fall back on cold, hard cash at stores without a contactless card reader. That said, with mobile payment increasing in popularity, this will become less and less of a problem in the future.

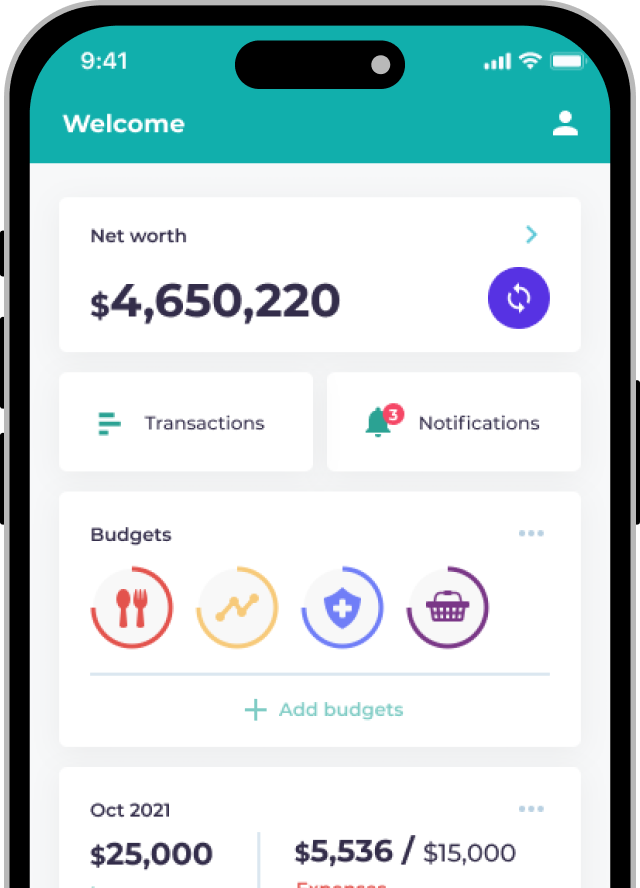

Hong Kong’s Virtual Credit Card Options

At the moment, CNCBI Motion Credit Card and ICBC UnionPay Dual Currency Greater Bay Area Virtual Digital Credit Card are the two options on the market.

The application and approval of the CNCBI card can be handled entirely on their dedicated mobile app, and the card supports Apple Pay, Google Pay and Octopus Card automatic top-up service; the ICBC card supports UnionPay and allows dual currency transactions (in HKD and RMB), fit for frequent Mainland-bound visitors.

Tip: Physical Card Still Has The Edge On Offers

The virtual credit card market is at its early stage in Hong Kong. If you are looking for better cashback rates, flight mileage and welcome offers, physical cards are still king for now. For example, PrimeCredit EarnMORE UnionPay Diamond Credit Card offers 2% cash rebate for linked Octopus Card automatic top-up service. Apply for the card through Planto to earn an extra $300. While you can find more offers and options in physical credit cards right now, we’ll see the odds even out as more virtual banks and cards like the Apple Card join the party, sooner or later.

Compare and find the right credit card for you:

No result found

Input a higher salary for more cards

Recommended Articles for You

Robo-Advisors Comparison:Chloe by 8 Securities, Kristal.ai, Aqumon