Historically, there’s been a couple of major ways you could invest your money:

- Do it yourself. Which means you would need to do tons of research into stocks, ETFs, bonds etc., figuring out which ones to buy, which brokerage to open an account with and more;

- Buy mutual funds or an investment insurance where you would essentially pay an investment manager to do the same with fees that are often 2% or more!

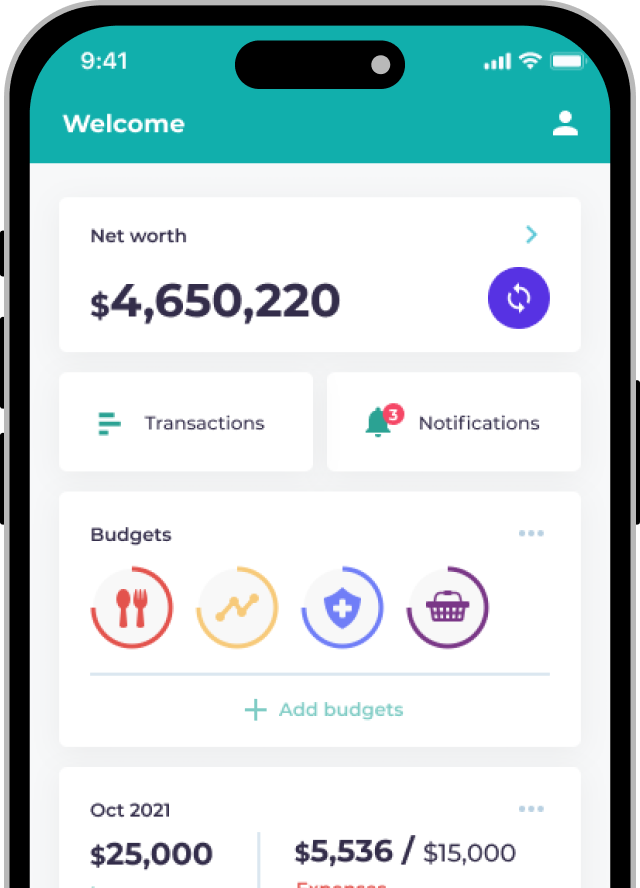

However, this is changing. In recent years, there have been a few fintech startups which are trying to find a middle-ground in Hong Kong: Robo-Advisors.

Robo-advisors are computer programs that will collect some information about you e.g. your current financial situation, goals and risk appetite and use that to create a diverse portfolio of stocks, bonds and funds personalised for you. Once you put your money in, they will automatically invest it on your behalf and since there’s no human intervention, they can cut costs and make management fees much lower for the consumers!

This leaves us with a few questions: how do robo-advisors compare to human investment advisors? And how do you, as an investor, choose which robo-advisor to go for?

We’ve done the hard work and looked into and interviewed the 3 major robo-advisors in Hong Kong; Chloe by 8 Securities, Kristal.ai and Aqumon to figure out how each one works, what their strengths are and how you can pick the best one for you.

Comparison: Human Advisor vs Robo-Advisor

Robo-Advisors: How do they stack up

Robo-Advisor FAQ

What are the advantages of robo-advisors?

- They are available 24/7: You no longer have to arrange a session to talk to your portfolio manager. You can adjust your portfolio, deposit or withdraw at any point, 24 hours a day.

- They have lower fees: Since it’s completely automated, the annual fees as well as the minimum required investments are lower, making them suitable for investors who don’t have a lot to invest.

- It’s convenient: After the portfolio setup, everything is handled by the robo-advisor – you don’t have to think about the market trends or have any investment knowledge.

- They stick to a consistent methodology: Since robo-advisors stick to their investment methodology, they are not affected by the day-to-day swings of the market and can avoid human errors.

- Their portfolios are diversified: Robo-advisors build a portfolio that consists of multiple types of assets (e.g. stocks, bonds, cash) from different geographies which spreads out your risk and makes your portfolio more stable.

What are the disadvantages of robo-advisors?

- They lack empathy: Good human consultants would want to understand you and your fears before recommending you a portfolio. They also serve as someone to talk to if you have concerns about the market, etc. Robo-advisors just follow the investment plan.

- They cannot guide you: Robo-advisors assume that the customer knows what they want – e.g. the goal they are setting for themselves, or how much risk they can bear. In reality, you may not truly understand how much risk you are willing to take or perhaps haven’t fully thought out when you would need your money or how much. This could result in a mis-match between the performance of the robo-advisor and expectations of the customer.

- The process is extremely passive: This isn’t truly a disadvantage but because robo-advisors follow their investment methodology unfailingly, in the case of adverse events like political factors that affect the economy, the robo-advisor may not adjust its portfolios. Given the lack of empathy (see above!), it may be a bit scary to see your portfolio falling in value (even if it’s temporary!).

Why do robo-advisors use ETFs?

ETFs(Exchange Traded Funds) refer to funds that are traded on the stock market that track an index. For example, The HK Tracker Fund (2800.HK) invests in all companies that exist on the Hang Seng Index (primarily blue chip) to simulate the performance of the entire index. The primary idea is: why invest in a single (just an example) banking stock where you take a lot of risk, when you can invest in ALL banking stocks at the same time for the same amount of effort. ETFs will have clear investment objectives (e.g. some are tracking the entire US stock market, some are only tracking high-quality bonds, etc.), are usually very liquid and can make diversification extremely easy which is why a lot of passive investors and robo-advisors prefer using them.

Are robo-advisors licensed?

Just like anyone else who offers investment advice on securities, robo-advisors are also licensed by the Securities and Futures Commission (SFC).

Are there hidden charges?

Robo-advisors are usually transparent about their fees (it’s one of their advantages!) but it’s always good to know the details before you start investing. Just reach out to the robo-advisors’ customer service if you have any specific questions.

What kind of people should use robo-advisors?

Robo-advisors are perfect for people who:

- Don’t have the time or interest to research investments

- People who are new to work-life and either don’t have enough money yet or aren’t sure how to start investing

- People who just want a simpler way to invest!

Can robo-advisors completely replace humans?

Robo-advisors perform a slightly different role as human advisors.

Robo-advisors are more about how to automate your investments cheaply and easily. In terms of performance, they’re still quite new so there isn’t enough data to accurately judge their performances.

Human advisors play a bigger role in helping you figure out what your financial goals and needs are, and to guide you on things you would eventually need to do. They also answer questions about big life decisions (from a financial perspective) e.g. how much should you save for your marriage or for your kids’ education, etc.

Is it safe to invest with a robo-advisor?

Robo-advisors are safe because they are regulated by the Securities and Futures Commission (SFC). In order to log into your robo-advisory accounts and invest, you will need to input your username, password, one-time password (OTP) and biometric authentication. In essence, it is the same as using your online banking services.

What happens when a major event occurs in the market? How does a robo-advisor respond?

Robo-advisors generally do not adjust their investments based on news reports directly. However, if a major event casts a longer-term market change, then the investment decisions of the robo-advisors may change.

Do robo-advisors rebalance your portfolio for you?

Kristal.ai told Planto that they will rebalance the portfolio every 6 months but the user will have to confirm if they want to do it. Chloe by 8 Securities refers to iFAST’s daily review of the portfolio health to decide if a portfolio is overly concentrated in a particular sector or country. Aqumon said it will only rebalance when a significant change occurs, so this is likely to be 2-3 times a year.

How long does it take to get my money out of a robo-advisor?

It usually takes 2-3 days for money to be transferred from a robo-advisor back into your account.

💡Want to track your investment performance easily? Download Planto now!💡