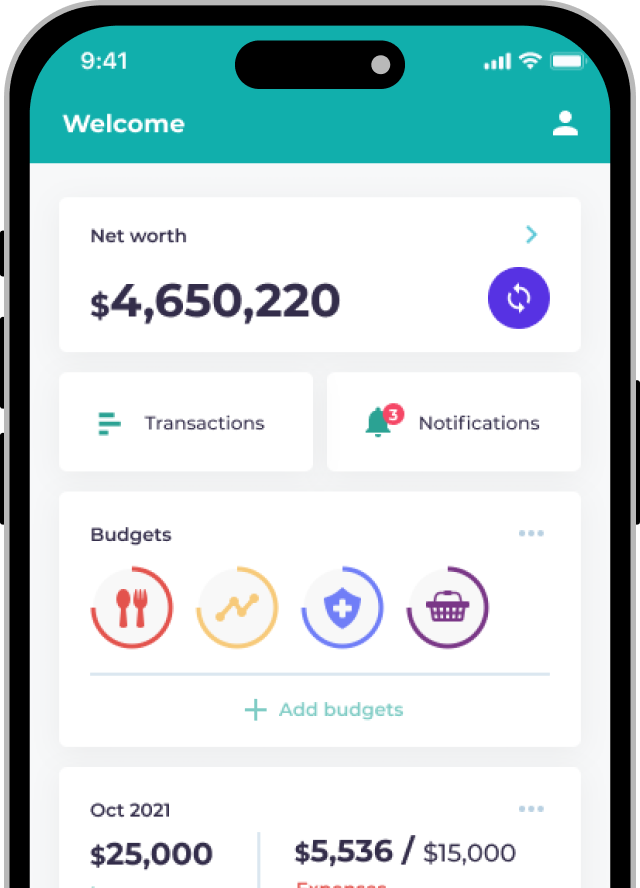

In recent years, more investment brokers have launched in Hong Kong, which is fantastic for consumers! Many of them have made investing very affordable, offer powerful stock research tools, and help you invest smarter. uSMART Securities has done all of the above—it helps you invest in HK and US stocks with low fees, uses big data to analyze stocks, and gives strategies to follow. On top of that, the app is simple to use and easy to get started with.

What’s great about uSMART?

- Low trading fees in the market for HK and US stocks

- Monthly investment plan available

- Fund platform where you can buy equity, bond or money market funds with ease

- AI-based stock screening tool

- Easy account opening (3 minutes to get started!)

- Simple app user interface

- IPO stock subscription available

- Licensed by the SFC for Type 1, 4 and 9 (your investments are protected!)

Opening uSMART Account in 3 Minutes

Opening a uSMART securities account is simple:

- Download the app and receive a verification code via SMS; (or log in with your Facebook or Google account)

- Use your phone to take pictures and upload your ID card and address proof

- Fill in some basic information such as name, contact, financial status, etc.

- Deposit funds and start investing

Deposit

- Support eDDA instant deposit (HSBC, Hang Seng Bank, Bank of China, DBS Bank, Bank of Communication, Chong Hing Bank, China Merchants Bank, CITIC Bank, China Minsheng Bank, Wing Lung Bank)

- FPS

- Bank account transfer

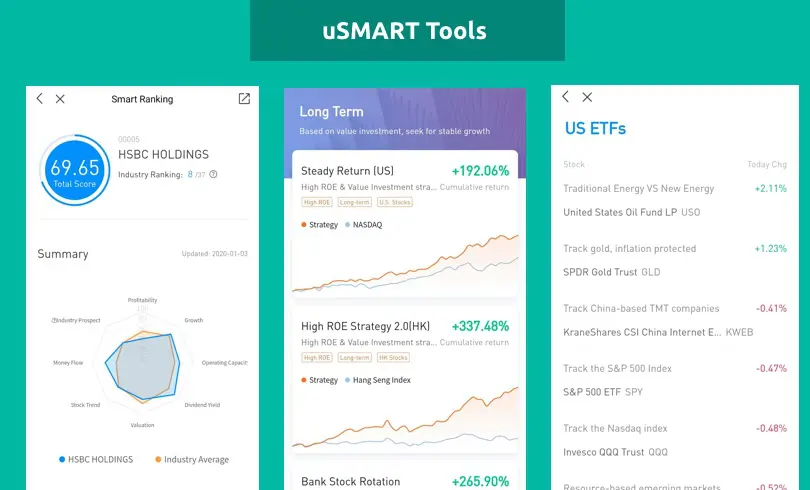

Stock Investment Tools and Research

On top of having really low fees, uSMART also provides you with stock research functionality that can be quite powerful. The key features are:

- Smart Advisor: This is an AI / Big Data driven stock screener that can help identify stocks based on various metrics including growth potential, price/earnings ratio and more. The performance is backtested but real-life performance over the long term remains to be seen – but it could still be a great tool to get ideas.

- Stock analysis: For individual stocks, aside from providing the price quote, uSMART provides intelligent scoring based on various factors of the company e.g. profit, growth, industry prospects, dividend yield, etc., and ranks them to help investors make more informed decisions.

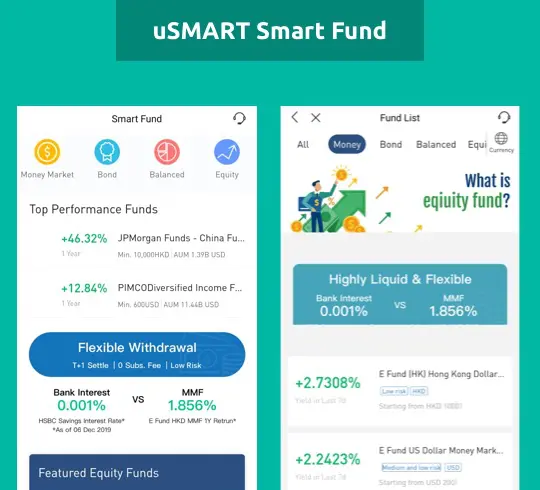

Smart Fund Platform

The funds on uSMART Securities platform are divided into four types: money market, bond, balanced and equity. Each fund has a chart to clearly show the performance trend, and lists the minimum investment amount and handling fee, which makes it straightforward for investors to choose what fund they are interested in.

- Money Market Funds: These have the lowest risk and invest mainly in Treasury bills, commercial paper, etc. Many investors may opt to use money market funds as a substitute for time deposit plans.

- Bond funds: The risks can be high or low, depending on the fund because bonds can have various risk levels (government bonds being lower risk, corporate and junk bonds being higher risk).

- Balanced funds: These funds are diversified across bonds, stocks and other products. The risk is variable depending on the holdings of the fund and thus reward is also variable.

- Equity funds: These have higher risk (and higher returns). The investments include various types of stock assets which also makes it an easy way to diversify risk.

Summary

The uSMART mobile app is powerful, affordable and easy to use. The Smart Advisor functionality is interesting but lacks real-life historical data to see if it really works and may take a while before it can be considered a replacement to robo-advisors.

The good news is, even if we exclude the smart advisor and analysis features, uSMART’s app is really good. Whether you’re a beginner or an experienced investor with a bank already, you’d want to give it a try yourself.

Discover the Best Investment Account Fees and offers

Important information:

Investment involves risks. This information is intended to be educational and is not tailored to the investment needs of any specific investor. This information does not constitute investment advice and should not be used as the basis for any investment decision nor should it be treated as a recommendation for any investment or action. Past performance is no guarantee of future results. The value of investments and the income from them can go down as well as up, so you may not get back what you invest.