In recent years, it’s becoming more common to open accounts with securities brokers rather than banks in order to save money on commissions and transaction fees for buying and selling stocks. However, there are still investors who use large banks and are worried about switching to a securities bank. What happens if the securities broker defaults’ – will you lose your money? What does the investor protection look like?

In order to protect investors, the Securities Regulatory Commission has established what it calls the Investor Compensation Company. Once a securities broker, bank, or other qualified intermediary fails or an event of default occurs, causing investors to suffer losses, investors can claim compensation from this fund.

How much you will be compensated

Under the current regulations, the Investor Compensation Fund will compensate investors up to HKD 500,000 in each case (since 1 Jan 2020) which is in line with the Deposit Protection Scheme. In other words, the compensation amount is the same as if your bank was to fail. In addition, the protection scope of this mechanism will also be expanded to invest through Northbound Connect, which will increase the protection for investors who wish to buy stocks via Shanghai Stock Connect and Shenzhen Stock Connect A shares through Hong Kong securities brokers.

Investors are able to claim under defaults that include “bankruptcy, winding up or insolvency or has committed breach of trust, defalcation, fraud or misfeasance”. The violating intermediary can be a licensed individual, or an institution such as a bank or a securities broker.

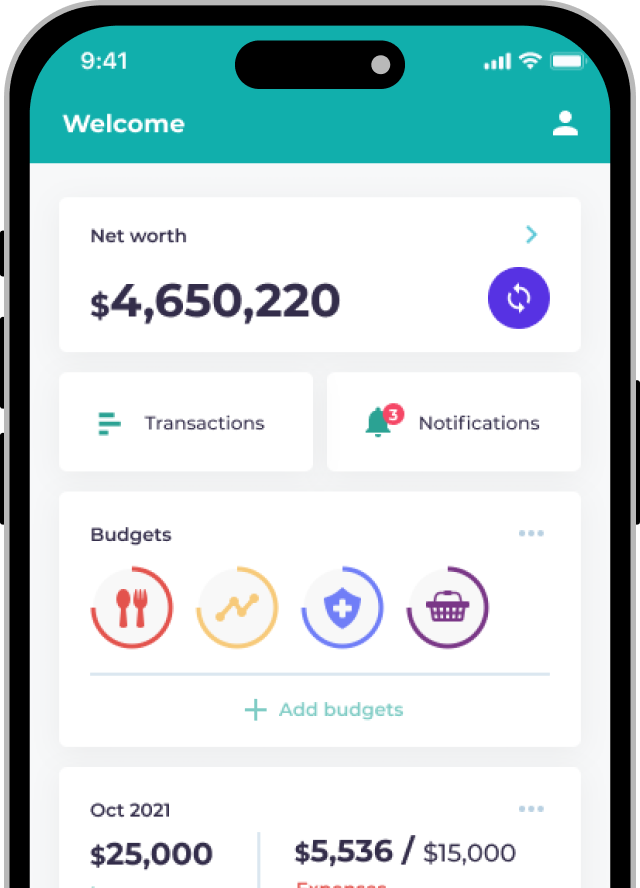

There are still some investors who would rather pay a higher commission for stock trading and choose to invest with large banks that they consider more robust. However, with the increase in the upper limit and scope of the protection amount, there’s very little reason to stick with the large banks. Along side the SFC-provided investor protection, uSMART Securities, 8 Securities and other emerging securities brokers also have lower fees and sometimes have promotional offers with stock and cash coupons.

Next steps

How compensation amount is calculated

Investor Compensation Co., Ltd. states that the amount of compensation received by investors from the relevant mechanism is calculated based on the closing price of securities on the date of breach. The following is an example of compensation based on the current compensation limit of HKD 500,000.

Lets say Mike bought the following portfolio on a certain date:

| Stock Name | # of Stocks | Purchase Price (HKD) | Total Price (HKD) |

| Company A | 10,000 | 25.5 | 255,000 |

| Company B | 8,000 | 21.0 | 168,000 |

| Company C | 40,000 | 3.7 | 148,000 |

| Total Investment | 571,000 |

However, his securities broker defaults on 22 December 2019. His holdings at the close of that date looked like this:

| Stock Name | # of Stocks | Current Price (HKD) | Total Price (HKD) |

| Company A | 10,000 | 20.0 | 200,000 |

| Company B | 8,000 | 15.0 | 120,000 |

| Company C | 40,000 | 3.0 | 120,000 |

| Total Investment | 440,000 |

In this case, Mike bought his stocks at HKD 571,000 and the securities broker defaulted on 22 December 2019, and the market price (on that date) was HKD 440,000. In this case, Mike would receive investor protection compensation of HKD 440,000.

Frequently Asked Questions about Investor Compensation

What is the maximum compensation limit for joint securities accounts?

The maximum compensation is calculated for each investor. Even if a joint securities account is used, the maximum compensation for each person is still HKD 500,000.

What is the maximum compensation limit for an investor who holds more than one account in a single bank or securities bank?

No matter how many securities accounts an investor holds in a default institution, the maximum compensation per person in a single default event is only HKD 500,000.

Can cash in securities accounts be protected?

The coverage of the compensation fund also includes cash in securities accounts, but the cash must be intended for purchase and sale of securities.

Important information:

Investment involves risks. This information is intended to be educational and is not tailored to the investment needs of any specific investor. This information does not constitute investment advice and should not be used as the basis for any investment decision nor should it be treated as a recommendation for any investment or action. Past performance is no guarantee of future results. The value of investments and the income from them can go down as well as up, so you may not get back what you invest.