While it is always better to prepare early when it comes to borrowing money, life often presents unexpected situations, and we may not be able to predict when we will need a loan. When traditional banks or lending companies are closed during late-night hours, Sundays, or on public holidays, 24-hour personal loans can provide immediate cash access.

What are 24-hour personal loans?

Traditional banks and lending companies typically operate from Monday to Saturday during regular office hours. Their staff processes loan applications and approvals during this time.

This limited availability may cause inconvenience for some borrowers who may be unable to apply during regular working hours or who urgently need a loan outside these hours. Some financial institutions offer 24-hour loans to address this issue, accepting applications and processing approvals anytime, even on Sundays and public holidays.

Find the Best Personal Loan Online 24/7

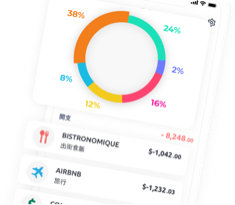

Comparing Virtual banks and lending companies’ 24-hour loans

Traditionally, most 24-hour personal loans are provided by lending companies. However, virtual banks have also started offering similar online lending services in recent years.

- 24-hour loans by lending companies: Some lending companies offer 24-hour personal loans that can be applied for over the phone or online. Customers do not need to visit in person and can submit required documents online. Approval may be faster if applying for a loan without proof of income, but the loan amount will likely be lower.

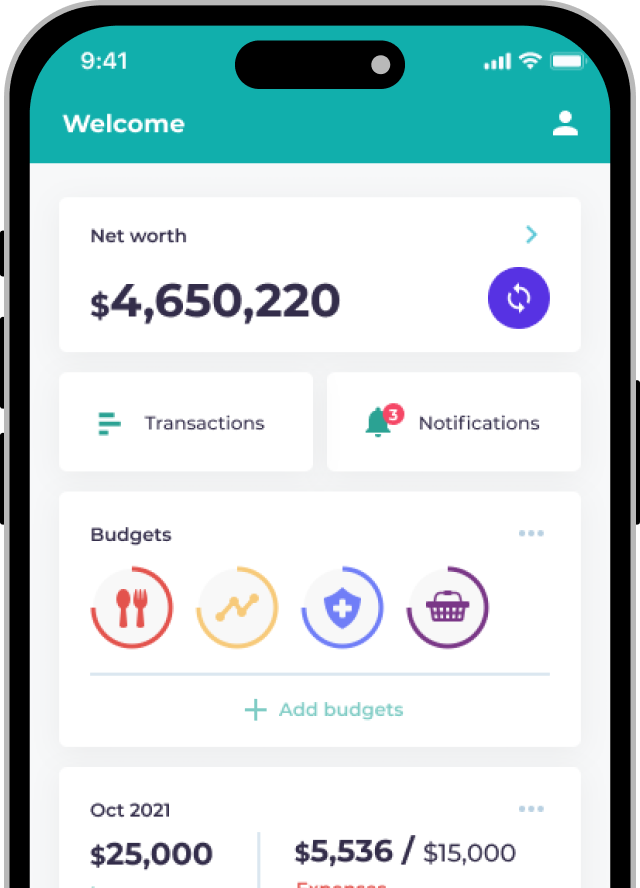

- 24-hour loans by virtual banks: In Hong Kong, virtual banks such as Airstar Bank and ZA Bank offer 24-hour personal loans. Customers can submit applications and upload necessary documents via mobile apps. Approvals are processed immediately, and customers can receive loans as fast as one hour.

Features of 24-hour personal loans

24-hour personal loans are flexible and designed to provide convenience for those needing funds. Their main features include the following:

- All-weather application and approval: Customers can apply for 24-hour loans at any time, including Sundays, public holidays, or outside regular office hours, via mobile apps, websites, or phone calls. However, some institutions may only accept applications 24/7 but process approvals during regular office hours, so inquire before applying.

- Simple application process: In many cases, 24-hour personal loans are designed for quick approval, and the document requirements are more relaxed. Some even offer loans without requiring proof of income or address.

- Lower loan amounts: Loans without proof of income or address typically have higher risks for lenders, so the approved loan amounts are usually lower.

- Higher interest rates from lending companies: Many 24-hour loans are provided by lending companies, which generally charge higher interest rates than virtual banks.

24-hour cash loan application process

The application process for 24-hour personal loans is similar to standard loans. Required documents usually include an ID card, proof of address, and proof of income. The specific steps and required documents vary depending on the lending institution and the borrower’s financial situation, but the main application process includes the following:

- Applying: Applicants can submit their 24-hour personal loan applications online, via phone, or mobile. Lending companies typically require applicants to provide their name, ID number, phone number, address, desired loan amount, occupation, and income status.

- Preliminary approval: Applicants usually receive an almost immediate preliminary decision on their 24-hour personal loan. They can confirm the loan if satisfied with the approved loan amount and annual interest rate. The lender may request additional documents to finalize the approval process.

- Loan disbursement: After final approval, applicants can confirm and withdraw the loan from the designated account.

FAQs for applying for a 24-hour personal loan

Regardless of how urgently you need to borrow money when using a 24-hour cash turnover loan product, you must be cautious. Here are some common questions:

Virtual bank loans generally have lower annual interest rates than financial companies. Of course, many factors affect the loan interest rate. Borrowers should compare the actual annual interest rate (APR) before deciding.

A 24-hour personal loan means that the application is accepted within 24 hours, and it does not promise approval and disbursement of the loan within 24 hours. Applicants may not be guaranteed to obtain the cash within 24 hours. Generally speaking, if the loan institution indicates that it is approved through big data or intelligent systems, the approval time will be shorter due to reduced manual operations. If time is tight, consider borrowing money from virtual banks such as ZA Bank and Airstar, or lenders such as Grantit and X Wallet, which usually provide quick results.

24-hour personal loans provide uninterrupted services so that money can be borrowed on Saturdays, Sundays, public holidays, or late at night. However, as mentioned above, some institutions only accept applications within 24 hours, but approval and disbursement can only be completed during office hours. Therefore, applicants should carefully check the details before applying.

Before applying for a personal loan, you must consider whether the loan institution will charge administrative fees, prepayment fees, etc. In addition, if the borrower fails to repay the loan on time, a penalty may be charged. Remembering the government’s call is also important: “You have to repay your loans. Don’t pay any intermediaries.”

To borrow or not to borrow? Borrow only if you can repay!