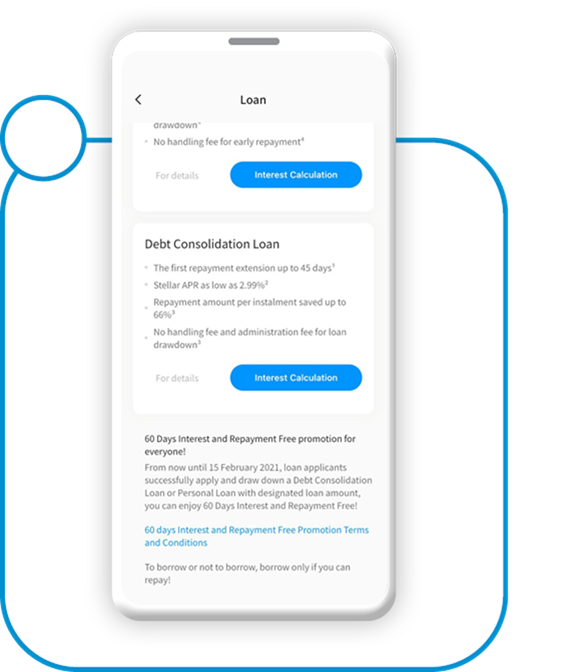

Stellar Personal Loan from a Hong Kong Virtual Bank

Loading...

About

?

Airstar Bank is one of the 8 virtual banks that received virtual bank license from Hong Kong Monetary Authority in 2019

The bank is a jointly established entity by Xiaomi Corporation, global IoT leader, and AMTD Group, Asia’s leading comprehensive financial services conglomerate.

Get loan from Airstar Bank in

3 simple steps

1

Register with your phone number

Follow the apply link to register your number and download the Airstar Bank mobile app

2

Apply for loan with

Airstar Bank mobile app

Apply for loan through Airstar Bank mobile app using your registered phone number

3

Loan approval & reward collection

Get loan disbursement & cash reward in your Airstar Bank account

Frequently Asked Questions

About personal loan

About repayment

What is an annualized percentage rate? (APR)

What documents are required for a loan application?

Over what period should I choose to repay the loan?

Would the loan information under the Loan be shown on my credit report?

To borrow or not to borrow? Borrow only if you can repay!

Contact Airstar Bank at Suites 3201-07, 32/F, Tower 5, The Gateway, Harbour City, Tsim Sha Tsui, Kowloon, Hong Kong or +852 3718 1818