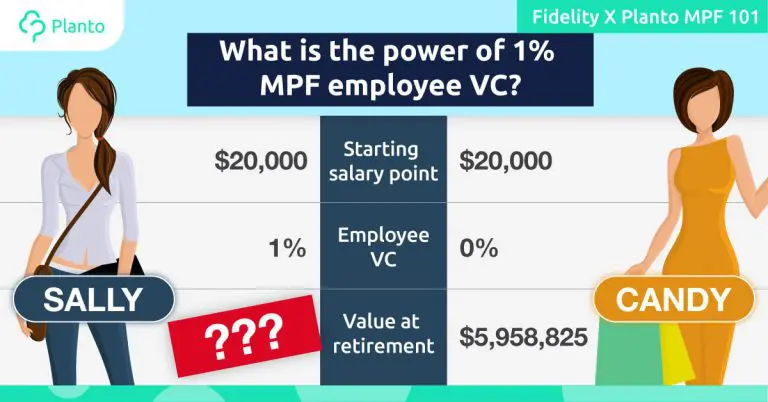

The MPF scheme requires employers and employees to contribute a minimum 5% of the employee’s monthly income. What if an employee made additional voluntary contributions (“VC”)? How would it impact the total MPF accrued benefits?

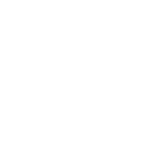

Let’s say Sally and Candy have the same monthly income. Sally started to contribute an additional 1% monthly income to the MPF account after getting paid for the first time at age 23, whilst Candy does not add any VC to her MPF account.

From the above, you can see that by contributing an additional 1%, Sally’s pool of retirement funds is higher than Candy by almost $600,000 when they reach 65.

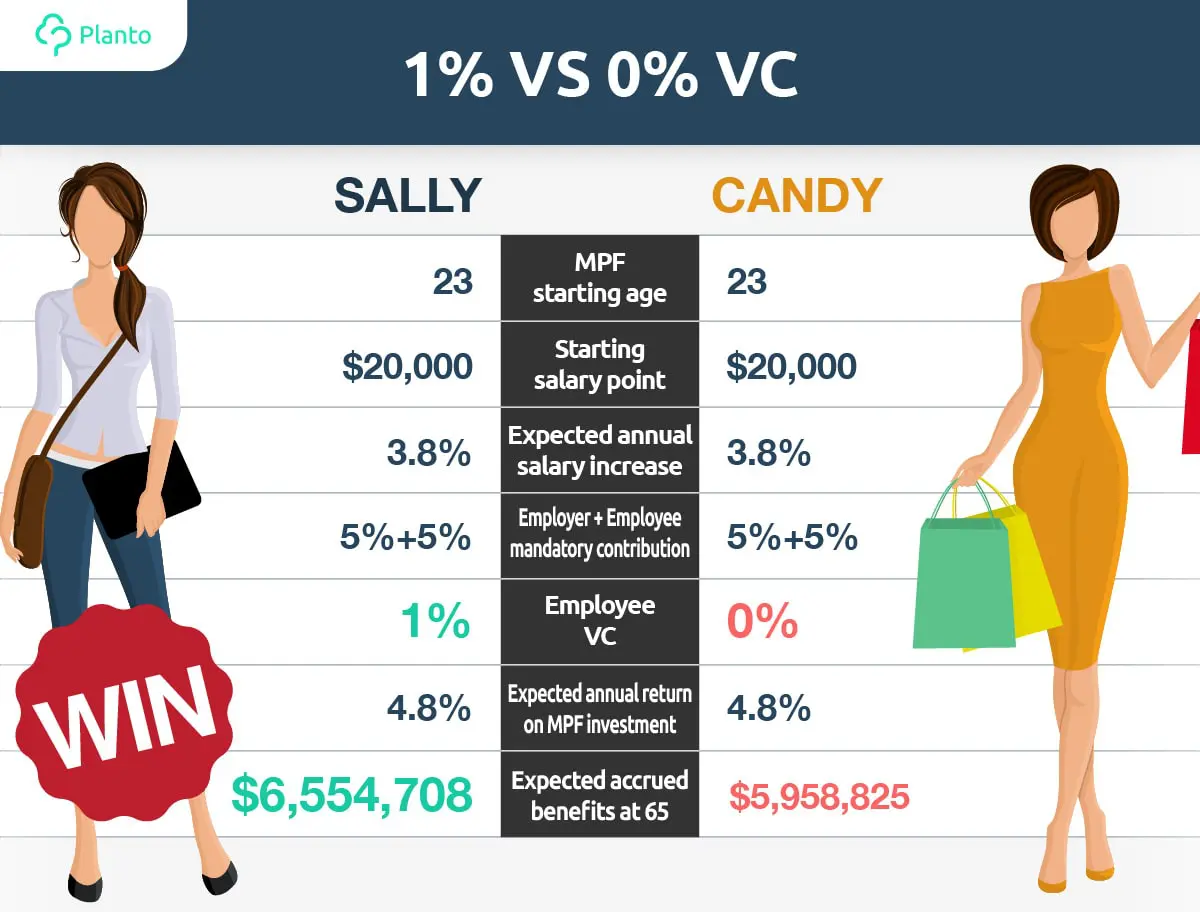

What if, lets say, 20 years later, Candy realises she has missed out and tries to keep up by making 2% of VC to her MPF. Can she keep up with Sally?

As you can see, even though her VC are 1% more than Sally’s, her overall accrued benefits are still lower. This shows that contributing more early on can definitely give you a head start. Why? Because of the power of compound interest. The earlier you start making additional VC , the bigger the snowball effect.

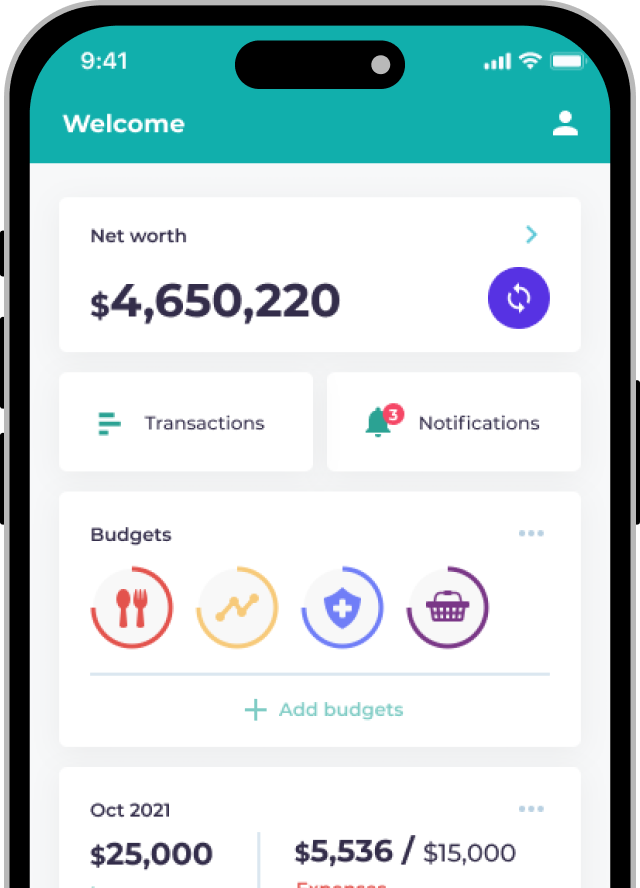

1% or 2% of your monthly income may only worth few cups of coffee today but it would be a significant portion of retirement assets in the long term if you allocate it to your MPF. Would you give up your daily morning Starbucks for the potential to increase your net worth at retirement?

Try out our MPF calculator to project your MPF accrued benefits in the upcoming years:

(The numbers in the above case uses the same assumptions in the Planto MPF calculator. All currency is in HKD.)

Learn more:

Learn more:

About Fidelity International

Fidelity International provides world class investment solutions and retirement expertise to institutions, individuals and their advisers – to help our clients build better futures for themselves and generations to come. As a private company we think generationally and invest for the long term. Helping clients to save for retirement and other long term investing objectives has been at the core of our business for 50 years.

FIL Investment Management (Hong Kong) Limited was established in Hong Kong in 1981 and is a subsidiary of Fidelity International. We have been managing retirement assets in Hong Kong since 1989. Fidelity is one of the largest MPF scheme providers in Hong Kong, offering members not only comprehensive product offerings but also competitive fees and professional services. With our outstanding investment capabilities and management quality, Fidelity MPF has captured a number of MPF industry awards over the years.

Today, Fidelity is the largest manager¹ in the ORSO employee choice market and the largest pure investment manager² to offer an MPF scheme.

Source:

¹ Willis Towers Watson “Manager Watch”, as at 31/12/2018.

² Mercer MPF Market Shares Report, as at 31/12/2018.

Important information

Investment involves risks. This material contains general information only. It is not an invitation to subscribe for shares in a fund nor is it to be construed as an offer to buy or sell any financial instruments. The information contained in this material is only accurate on the date such information is published on this material. Opinions or forecasts contained herein are subject to change without prior notice. Reference to specific securities mentioned within this material (if any) is for illustrative purpose only and should not be construed as a recommendation to the investor to buy or sell the same. Any person considering an investment should seek independent advice. FIL Limited and its subsidiaries are commonly referred to as Fidelity or Fidelity International. Fidelity, Fidelity International, and the Fidelity International logo and F symbol are trademarks of FIL Limited. This material is issued by FIL Investment Management (Hong Kong) Limited and Planto, and has not been reviewed by the Securities and Futures Commission.

This information is intended to be educational and is not tailored to the investment needs of any specific investor. This information does not constitute investment advice and should not be used as the basis for any investment decision nor should it be treated as a recommendation for any investment or action.

The results of the projection of MPF accrued benefits is calculated based on certain assumptions and it is for reference only.

Investment involves risks. Past performance is no guarantee of future results. The value of investments and the income from them can go down as well as up, so you may not get back what you invest. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

The third party mark appearing in this material is the property of the respective owner and not by Fidelity.

This material may contain materials from third parties which are supplied by companies that are not affiliated with any Fidelity entity ("Third Party Content"). Fidelity has not been involved in the preparation, adoption or editing of such third party materials and does not explicitly or implicitly endorse or approve such content. Any opinions or recommendations expressed on third party materials are solely those of the independent providers, not of Fidelity. Third Party Content is provided for informational purposes only.