Tax is one of the things everyone hates – but there are ways to reduce it! One option is to make use of Tax Deductible Voluntary Contribution (TVC). In this article, we will show you the benefits of TVC, steps to open a TVC account and how to apply for tax deductions.

TVC applications are rapidly increasing

According to Fidelity International, more than 80% of Hong Kong people were positive about the government’s new tax-deductible financial products e.g. TVC and QDAP and VHIS. Based on MPFA’s research, as of September 2019, there were 19,000 TVC accounts held by Hong Kong employees, which was a five-fold increase from April 2019 (3,400 TVC accounts)!

| Date | Contribution Accounts | Personal Accounts | TVC Accounts |

| 30/6/2019 | 4,183,000 | 5,723,000 | 13,000 |

| 30/9/2019 | 4,228,000 | 5,771,000 | 19,000 |

| Growth Rate | +1.07% | +0.83% | +46.15% |

Although TVC has been growing since its launch, it still accounts for less than 0.2% of the total MPF accounts.

Benefits of TVC

Pay less tax

TVC contributions can be included in tax deductions under salaries tax or tax under personal assessment, with a maximum cap per year of $60,000 (which is an aggregate limit for TVC and qualifying deferred annuity policies premiums). It can save you up to HK$10,200 in tax each year. Click here to know more about TVC tax deductions!

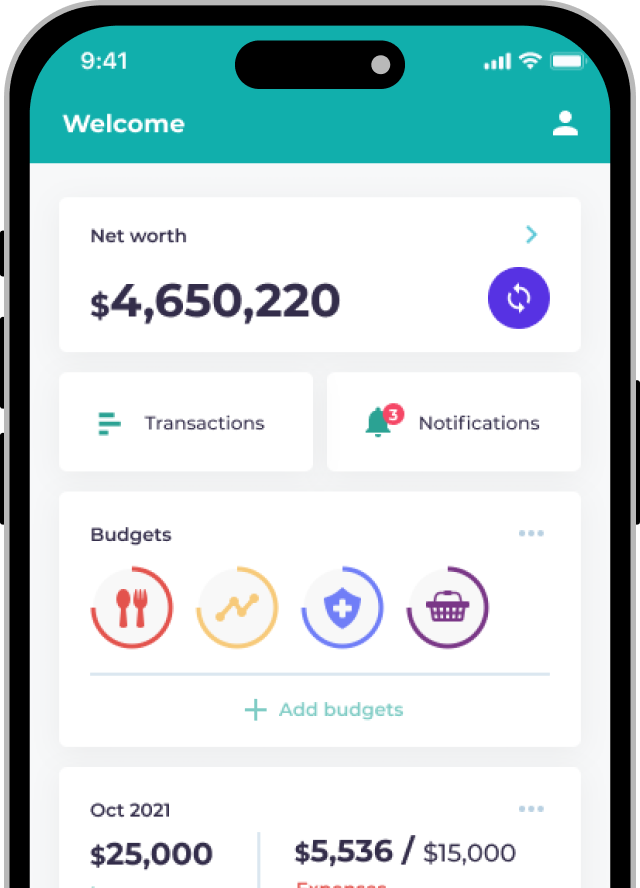

Increase your net worth

Under the fierce inflation in Hong Kong, relying on MPF contributions alone may not be enough to support retirement life. If you put away just a few hundred dollars each month for voluntary contributions, your net worth at retirement can be increased by millions.

How to open a TVC account

Opening a TVC account is simple. You just need to request a TVC application form from your MPF provider, complete the form and return it with copies of HKID card and residential address proof.

Steps to apply for a TVC account using physical form

Application form can be downloaded from MPF trustee’s website. You can then apply for an account

following these 3 steps:

- Complete your personal and employment information such as name, date of birth, contact details etc. Since TVC accounts are not opened with employers, additional information such as income and job position will be required

- Choose a contribution model, whether this is lump sum or regular monthly contribution. Lump sum payment method requires a cheque while regular monthly contribution requires a Direct Debit Authorization form

- Choose your funds and investment allocation. If there is no instruction or the instruction is not clear, the contributions will be invested according to the Default Investment Strategy (DIS)

Steps to apply for a TVC account online in 15 minutes

Some MPF trustees have launched mobile application to facilitate online TVC account opening. For example, Fidelity’s SmartRetire app allows you to open a TVC account completely online, from the comfort of your home. The account can be opened following 3 simple steps:

- Download the SmartRetire app and choose an open to apply for a TVC account

- Verify your identity through the app, fill in electronic form and choose investment allocation

- Confirm payment method, arrange for payment then complete your application using electronic

signature

How to transfer TVC assets

You can only transfer balance from one TVC account to another. So if you have multiple TVC accounts (one for each MPF scheme), you may want to consolidate it all. Once you do that, your TVC account in the original scheme will be terminated. Transfer forms are downloadable from websites of MPFA or from your current MPF provider.

How to apply for TVC tax deductions

To apply for TVC tax deductions, you simply need to claim the deductions in the Tax Return (BIR60). If you have already submitted the 2019/20 tax return, you may apply for correction within 6 years after the end of the relevant year of assessment.

You won’t need to attach any supporting documents to the tax returns but you should retain the contribution summaries by the trustees for 6 years, in case of a selected review by the HK IRD.

In addition, if a TVC member also has qualifying annuity premiums, the TVC deductions would be claimed first. Lastly, you only claim tax deductions from your personal account, not family members’ account.

“In this world nothing can be said to be certain, except death and taxes,” said Benjamin Franklin. Taxes may be certain but we can be smart about it – pay less tax but use it to increase your net worth and strengthen your financial foundation after retirement.

—

Important information

Investment involves risks. This material contains general information only. It is not an invitation to subscribe for shares in a fund nor is it to be construed as an offer to buy or sell any financial instruments. The information contained in this material is only accurate on the date such information is published on this material. Opinions or forecasts contained herein are subject to change without prior notice. Reference to specific securities mentioned within this material (if any) is for illustrative purpose only and should not be construed as a recommendation to the investor to buy or sell the same. Any person considering an investment should seek independent advice. FIL Limited and its subsidiaries are commonly referred to as Fidelity or Fidelity International. Fidelity, Fidelity International, and the Fidelity International logo and F symbol are trademarks of FIL Limited. This material is issued by FIL Investment Management (Hong Kong) Limited and Planto, and has not been reviewed by the Securities and Futures Commission.

This information is intended to be educational and is not tailored to the investment needs of any specific investor. This information does not constitute investment advice and should not be used as the basis for any investment decision nor should it be treated as a recommendation for any investment or action.

The results of the projection of MPF accrued benefits is calculated based on certain assumptions and it is for reference only.

Investment involves risks. Past performance is no guarantee of future results. The value of investments and the income from them can go down as well as up, so you may not get back what you invest. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The third party mark appearing in this material is the property of the respective owner and not by Fidelity.

This material may contain materials from third parties which are supplied by companies that are not affiliated with any Fidelity entity (“Third Party Content”). Fidelity has not been involved in the preparation, adoption or editing of such third party materials and does not explicitly or implicitly endorse or approve such content. Any opinions or recommendations expressed on third party materials are solely those of the independent providers, not of Fidelity. Third Party Content is provided for informational purposes only.