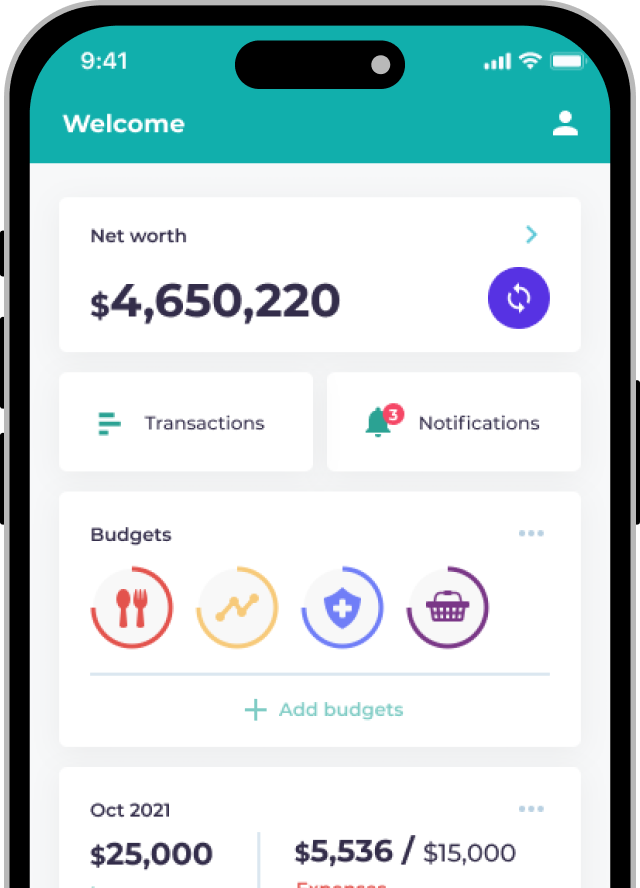

When faced with a large or multiple credit card debts, it may be tempting to get by with minimum payment in each month. However, this will likely lead to an accumulation of high interest debt. In this situation, debt consolidation is a common solution to simplify loan repayment and reduce an overall interest expense for borrowers.

Airstar Bank is offering a debt consolidation loan which is suitable for consumers who are currently paying one or more high interest loans (such as credit card balance, credit card cash advance or an overdraft facility).

Learn more:

- Key features of Airstar Bank Debt Consolidation Loan

- Apply for a debt consolidation loan with Airstar in a few simple steps

- Understand the benefits of a debt consolidation loan

Key features of Airstar Bank Debt Consolidation Loan

Enjoy an exclusive welcome reward by completing a simple application via Planto

Enjoy up to HK$27,200 in reward value by successfully apply for Debt Consolidation Loan via Planto on or before 31 July 2023 and drawdown by 31 August 2023. Rewards may include HK$400 loan rebate coupon, cash rebate and exclusive e-vouchers from Planto (choose from Parknshop/Apple/HKTV Mall e-vouchers).

| Drawdown amount & Tenor | Rewards | |

| Rewards from Airstar Bank | Drawdown amount exceeding HK$200,000 + tenors of 24/36 months | 🎁 ^Cash Rebate HK$200,000 – HK$499,999 = HK$2,500 HK$500,000 – HK$799,999 = HK$3,400 HK$800,000 – HK$999,999 = HK$5,000 HK$1,000,000 – HK$1,199,999= HK$6,900 HK$1,200,000 or above = HK$8,400 |

| Rewards from Airstar Bank | Drawdown amount exceeding + tenors of 48/60/72 months | 🎁 ^Cash Rebate HK$200,000 – HK$499,999 = HK$5,000 HK$500,000至 HK$799,999 = HK$6,800 HK$800,000至 HK$999,999 = HK$10,000 HK$1,000,000至 HK$1,199,999= HK$13,800 HK$1,200,000或以上 = HK$16,800 |

| Exclusive Rewards from Planto | Drawdown amount exceeding HK$200,000 + tenors of 24 months or longer | 🎁 ^Exclusive 3 Pick 1 Rewards:Up to HK$10,000 ParknShop/Apple/HKTV Mall e-vouchers Planto Reward Redemption Form |

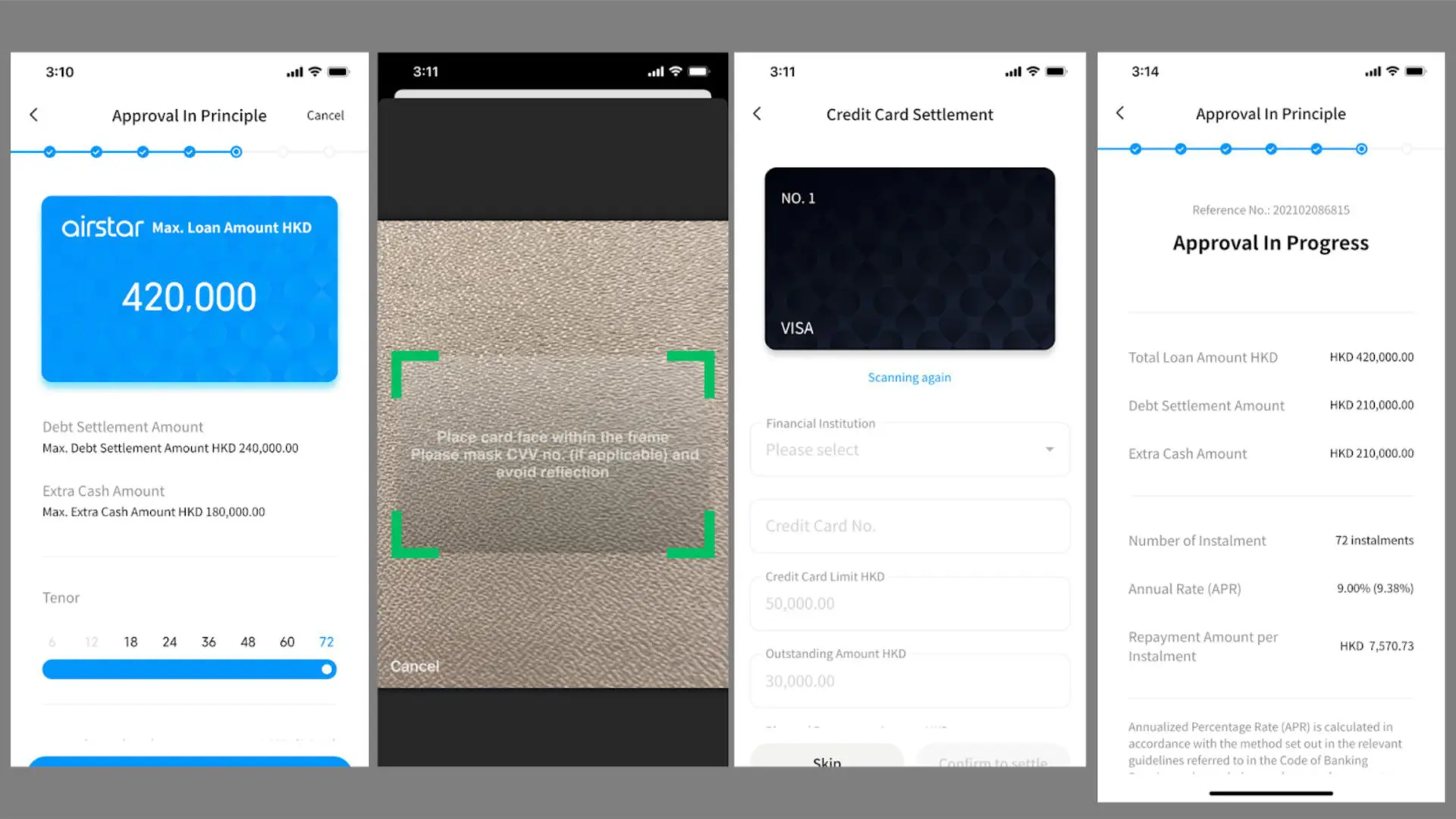

Apply for a debt consolidation loan with Airstar in a few simple steps

- Submit initial loan and personal information

(IDV & Selfie are needed for new customers)

- Receive an initial approval in principle results

- Three step setup of a settlement plan:

A- Set Loan Settlement Details

B- Set Credit Card Settlement Details (OCR: Credit Card Numbers)

C- Confirm required extra cash out option

- Provide supplement document

(Support PDF & photos upload)

- Receive a final offer

- Credit card balances will be paid off automatically; Loans will be settled manually by Airstar Bank (if any)

Understand the benefits of a debt consolidation loan

Key feature of a debt consolidation loan is to repay and consolidate one or multiple high interest loans into a single sum which typically has a lower interest rate and a longer repayment period. Borrowers can also choose to take out extra cash out for other usage on top of repayment of existing loans.

| Debt consolidation loan | General personal loan | |

| Interest rate (APR) | Typically between 5% to 19%. Airstar Bank is offering APR as low as 2.99% | Typically between 4% to 18% |

| Loan amount | As high as 18 to 21 times of monthly salary | As high as 8 to 12 times of monthly salary |

| Repayment period | Generally 6 to 72 months | Generally 6 to 60 months |

| Loan disbursement | Direct deposit/repayment into credit card or designated loan accounts. Part of the loan amount can be cashed out | Cash withdrawal or bank transfer |

There are many debt consolidation loan offers on the market. Borrowers should watch out for the following factors before making any decision:

- APR: debt consolidation loan can be an effective mean to lower down borrower’s interest expense. Consumers should do research and find a plan that can save the most interest expense

- Loan eligibility: while debt consolidation loan typically has a more accommodating eligibility criteria, a bad credit score can still lead to a higher interest rate which will reduce the amount of interest expense saving from consolidating loans

- Repayment ability: while borrowers can extend their repayment timeline using a debt consolidation – the debt still need to be repaid so all consumers should review their cashflow and ensure that they can keep up with the repayment plan before taking any loan

- Practice financial management: after taking a debt consolidation loan, borrowers can then enjoy a single loan with a lower interest and a longer repayment period. However it is still important to learn from past experience and avoid taking on high interest or multiple loans in the future

To borrow or not to borrow? Borrow only if you can repay!

![[Airstar Bank Debt Consolidation Loan] Repay your existing loan and enjoy an exclusive welcome reward!](https://d3pwh2ime6p0el.cloudfront.net/wp-content/uploads/2021/03/Debt-Consolidation-Loan-Airstar-bank-768x402.jpg.webp)