Staff benefits is a hot topic amongst the Hong Kong working population, with MPF being one of the most talked about subjects due to its impact towards an employee's retirement. Whilst the standard for the mandatory employer contributions is 5% for each employee, many employers go beyond and offer higher contributions.

The fact is not all of us can rely on our employers, but it is still possible to be better prepared for retirement on your own. How? You can choose to make additional voluntary contributions to your MPF.

What are Voluntary Contributions?

Voluntary Contributions can be divided into Employee Voluntary Contributions (Employee VC), Special Voluntary Contributions (SVC) and Tax deductible Voluntary Contributions (TVC). Despite having similar names, these three work quite differently.

Employee Voluntary Contributions (Employee VC)

You can set up your Employee VC via your employer with the monthly contributions based on your income, where accrued benefits can be withdrawn or transferred at the end of your employment. Some employers may offer voluntary contributions as part of their staff benefits where the accrued benefits can be withdrawn or transferred according to the terms made in the employment contract at employment termination.

If you are satisfied with the performance of your employer’s MPF provider, you choose to increase your employee contributions to more than 5% under the same scheme to scale up your MPF investments and savings. Employee VC can be completely withdrawn or transferred at the end of your employment.

Special Voluntary Contributions (SVC)

SVC is not related to your employer. It is more flexible given you can select your own trustees and liaise with the them directly to open an account. You dictate how much you would like to contribute, which does not have to be fixed and you can withdraw or transfer the accrued benefits anytime (Note: Arrangements vary among different providers). Unlike Employee VC, you can withdraw the accrued benefits in your SVC account anytime (without having to wait till you leave the company), making it a more flexible investment tool.

Tax Deductible Voluntary Contributions (TVC)

The government introduced tax deductions for deferred annuity premiums and Mandatory Provident Fund Tax Deductible Voluntary Contributions (TVCs) to encourage voluntary savings for retirement, with the maximum deductible amount being capped at $60,000. However, TVC can only be withdrawn at the age of 65. Click here to learn more about TVC.

| Employee VC | SVC | TVC | |

|---|---|---|---|

| Account Opening | Via your employer | You choose your own trustee | You select your own TVC scheme |

| Contribution arrangements | The amount of contributions is based on your income; Regular contributions of a fixed amount; Contributions are made to the trustee via your employer. | The amount of contributions is not based on your income; Contributions amounts are not fixed; Contributions are made to the trustee by yourself. | The amount of contributions is not based on your income; Contributions amounts are not fixed; Contributions are made to the trustee by yourself. |

| MPF benefits withdrawal & transfer | You can withdraw or transfer your MPF benefits only after ceasing employment. | You can withdraw or transfer your MPF benefits anytime; You can withdraw benefits several times a year. There may be a minimum amount for each withdrawal and a maximum number of withdrawal that could be made. Such rules vary among trustees. | You can withdraw your accrued benefits at age 65 (or on other statutory grounds); The accrued benefits are transferable to another TVC account anytime. |

| Tax deduction | Not tax deductible | Not tax deductible | Tax deductible |

Why are Voluntary Contributions important ?

Hong Kong people have a long life expectancy

Hong Kong people are known to have high life expectancies. The life expectancy of a male and a female are 82.2 and 87.6 respectively, with the retirement age being between 55-65. With an extra 20+ years after retirement, we have to be well prepared for life after employment and adding a bit more to our voluntary contributions can help with that.

It is a way to fight against inflation

Aside from 1999 and 2004, Hong Kong has witnessed positive inflation rate in the past 30 years. This means that the purchasing power of the money you have today will likely be weakened over time if you just leave it in the bank or in cash. As such, increasing your MPF contributions is a great alternative to battling against inflation and keeping the value of your hard earned cash.

You can experience more of the power of compounding

The earlier you start investing, the more you will get upon retirement due to the power of compounding. The difference between making an additional few hundred dollars of contributions to your MPF and not making any could be significant in the long term.

It’s a great way to learn about investing

Many of us want to invest, but aren’t comfortable or confident in investing in the markets by ourselves. Since MPF is mandatory for the working population in Hong Kong, it is a great way for beginners to take the opportunity to learn how investing works.

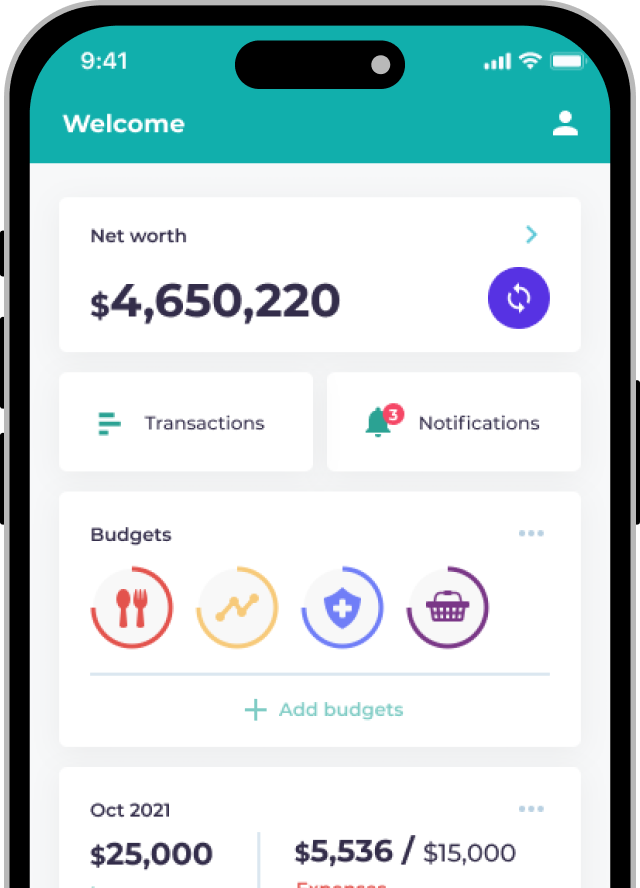

Try out our MPF calculator to project your MPF accrued benefits in the upcoming years:

(All currency is in HKD.)

About Fidelity International

Fidelity International provides world class investment solutions and retirement expertise to institutions, individuals and their advisers – to help our clients build better futures for themselves and generations to come. As a private company we think generationally and invest for the long term. Helping clients to save for retirement and other long term investing objectives has been at the core of our business for 50 years.

FIL Investment Management (Hong Kong) Limited was established in Hong Kong in 1981 and is a subsidiary of Fidelity International. We have been managing retirement assets in Hong Kong since 1989. Fidelity is one of the largest MPF scheme providers in Hong Kong, offering members not only comprehensive product offerings but also competitive fees and professional services. With our outstanding investment capabilities and management quality, Fidelity MPF has captured a number of MPF industry awards over the years.

Today, Fidelity is the largest manager¹ in the ORSO employee choice market and the largest pure investment manager² to offer an MPF scheme.

Source:

¹ Willis Towers Watson “Manager Watch”, as at 31/12/2018.

² Mercer MPF Market Shares Report, as at 31/12/2018.

Important information

Investment involves risks. This material contains general information only. It is not an invitation to subscribe for shares in a fund nor is it to be construed as an offer to buy or sell any financial instruments. The information contained in this material is only accurate on the date such information is published on this material. Opinions or forecasts contained herein are subject to change without prior notice. Reference to specific securities mentioned within this material (if any) is for illustrative purpose only and should not be construed as a recommendation to the investor to buy or sell the same. Any person considering an investment should seek independent advice. FIL Limited and its subsidiaries are commonly referred to as Fidelity or Fidelity International. Fidelity, Fidelity International, and the Fidelity International logo and F symbol are trademarks of FIL Limited. This material is issued by FIL Investment Management (Hong Kong) Limited and Planto, and has not been reviewed by the Securities and Futures Commission.

This information is intended to be educational and is not tailored to the investment needs of any specific investor. This information does not constitute investment advice and should not be used as the basis for any investment decision nor should it be treated as a recommendation for any investment or action.

The results of the projection of MPF accrued benefits is calculated based on certain assumptions and it is for reference only.

Investment involves risks. Past performance is no guarantee of future results. The value of investments and the income from them can go down as well as up, so you may not get back what you invest. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

The third party mark appearing in this material is the property of the respective owner and not by Fidelity.

This material may contain materials from third parties which are supplied by companies that are not affiliated with any Fidelity entity ("Third Party Content"). Fidelity has not been involved in the preparation, adoption or editing of such third party materials and does not explicitly or implicitly endorse or approve such content. Any opinions or recommendations expressed on third party materials are solely those of the independent providers, not of Fidelity. Third Party Content is provided for informational purposes only.

![[MPF 101] Voluntary Contributions? – A breakdown of the three types](https://d3pwh2ime6p0el.cloudfront.net/wp-content/uploads/2019/12/en-fidelity-3-ct-_revised-768x402.jpg.webp)