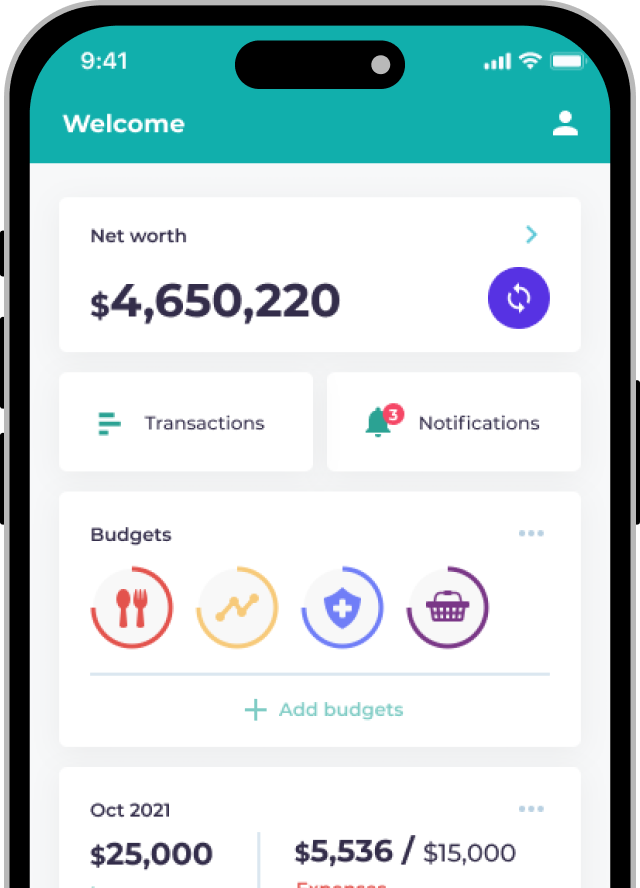

👉 Borrowing Money Guide 2023: Hong Kong is still in a period of rising interest rates this year, making borrowing money a scarce opportunity. Choosing loan products requires extraordinary astuteness and caution.

Banks or financial companies provide online instant loans if you urgently need funds. Borrowers can receive preliminary approval within minutes and withdraw the loan within an hour. 🎁 Take a look at the table below for the borrowing promotions available:

Comparison of Loan Interest Rates among Banks and Financial Institutions

Life is full of ups and downs. If you’re faced with major life events such as starting a business, buying a property, furthering your education, or undergoing surgery and need immediate funding, borrowing money is the most direct solution.

In Hong Kong, there are many channels for borrowing loans, each with pros and cons. Below, we summarize the advantages and disadvantages of different borrowing methods, teaching you how to choose your most suitable borrowing path.

1) Borrowing Money Through Banks and Financial Companies

Nowadays, banks and financial institutions offer many private loan products, which can be broadly categorized into secured and unsecured loans. Secured loans include mortgages, cash-out refinancing, car loans, etc. These loans typically involve collateral, which allows borrowers to secure higher loan amounts and lower interest rates. The maximum amount that can be borrowed depends on the value of the collateral, and in the event of default, the lender has the right to repossess the collateral.

Alternatively, unsecured loans, such as tax loans, balance transfers, and personal installment loans, are also available. The loan amount that can be obtained depends on the borrower’s income and credit history. When applying for an unsecured loan, documents such as proof of income and address are typically required, and the interest rates tend to be slightly higher than those for secured loans.

2) Borrowing Money Through Online Loans with No Documentation Required

For individuals with unstable income or self-employed status, applying for a private loan can be difficult due to the inability to provide income documentation. In such cases, “no documentation loans” provided by banks and financial institutions can be viable.

These loans enable borrowers to skip certain specified documents, with the most common exemption being income proof, which typically includes pay slips and tax returns. All that is required is a valid ID and proof of address to apply for a private loan, and in some cases, even the latter can be waived.

The application process is streamlined, and many lenders offer online submission of required documents, with approval times as fast as 30 minutes, catering to the needs of those requiring immediate cash flow.

However, as the name implies, no documentation loans come with a catch. The loan amount approved for such loans is usually lower due to the lack of documentation, and because lenders have less stringent requirements for proof of income and address, there is a higher risk of default. As a result, interest rates for these loans tend to be higher than those for regular private loans. Exercising prudence and weighing the risks before borrowing under such circumstances is essential.

3) Borrowing Money from Relatives and friends

When faced with unexpected financial difficulties, seeking help from trusted family and friends is often the quickest solution. Borrowing money from them is the easiest method, as it doesn’t require income verification, interest payments, or even a repayment deadline.

However, the amount that can be borrowed depends on the relationship between the borrower and the lender and the lender’s financial situation. It may only sometimes be enough to solve the borrower’s financial problems. Although borrowing money from family and friends doesn’t require a formal repayment deadline, the proverbial saying “money talks, but it also ruins relationships” applies. Repaying the loan on time can maintain the relationship, so it’s best to establish a repayment plan and gradually pay off the debt to avoid awkwardness when meeting with the lender.

When borrowing money from family and friends, the borrower will inevitably be asked about the reason for the loan. Additionally, without a confidentiality agreement, the news of the loan could spread among other family and friends. Therefore, it’s essential to consider the impact on your relationship before asking for a loan from friends and family.

4) Cashing Out Money Through Credit Cards

Another method of borrowing money is to use credit cards to withdraw cash. Many Hong Kong residents have several credit cards, and when needing immediate cash, they may use their credit card limit to withdraw extra money.

The credit card limit can be used for cash overdrafts, meaning that cash can be withdrawn directly from ATMs, depending on the credit limit. However, the annual interest rate on credit cards can be as high as 40%, and interest is calculated daily. If the borrower doesn’t repay the amount in full on time, they may incur monthly processing fees.

Another way to obtain money from a credit card is through a cash advance, which requires the borrower to apply to the bank. No income proof is needed, and the loan can be approved within one to two working days. The loan amount depends on the credit limit of the credit card and the borrower’s credit status, and the annual interest rate can be as low as 3%.

Never Attempt to Borrow from Loan Sharks

When in urgent need of money, it is easy to resort to desperate measures. Every day we may receive multiple loan offers from anonymous calls, claiming that no proof of income or identification is necessary and that we simply need to complete a few simple procedures to borrow the money we need.

However, being wary of these unknown lenders is important, as they may be loan sharks (大耳窿). These easy-to-obtain loans may come with exorbitant interest rates and handling fees.

There was once a case in Hong Kong where a borrower borrowed HK$2,000 from a loan shark, but after deducting the relevant fees, the borrower only received HK$1,400. The borrower had to pay HK$200 per week in interest and was asked to pay an additional HK$5,000 in extra interest due to late repayment. In the end, the borrower paid back HK$20,200 within 7 days, but the loan shark continued to demand repayment for different reasons.

After borrowing from a loan shark, the debt can quickly spiral out of control. Even more frightening is that loan sharks may use different methods to intimidate borrowers into repayment, such as harassing their family and neighbors, pouring red paint, or even threatening the borrowers to take nude photos. Therefore, it is crucial to avoid loan sharks, as it could lead to even more severe consequences.