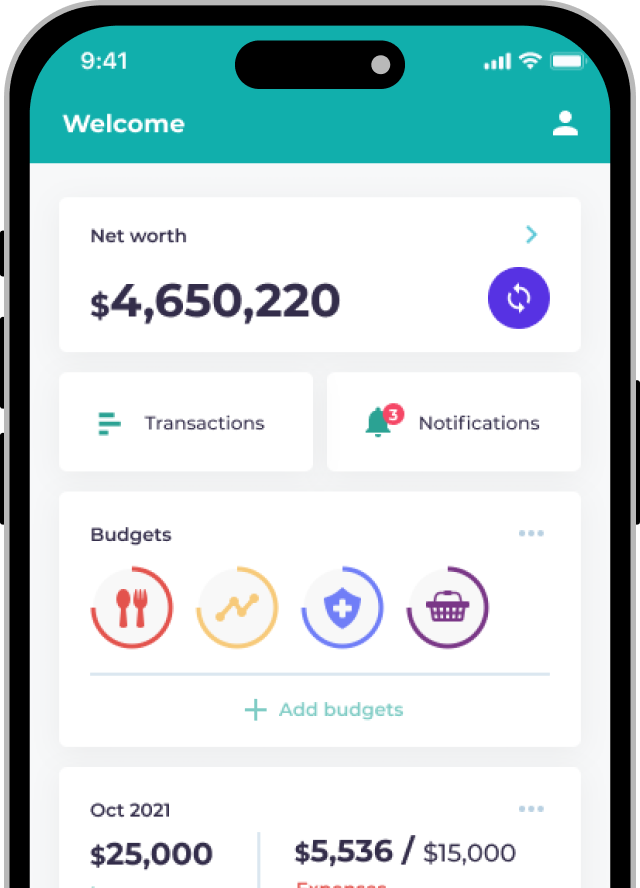

It's tax season – and all major banks are beginning to offer tax loan products. It's a big deal because these tax loans have lower interest rates than most personal instalment loans!

Although with tax loans, you are supposed to be "borrowing to pay your tax", banks don't generally restrict how you can use these borrowed funds, essentially giving taxpayers a great opportunity to borrow money at a lower interest rate.

Looking at this year's tax loan products, the benefits offered by banks are quite attractive due to the interest rate cut cycle. In the case of the Bank of East Asia (BEA), designated customers can enjoy a discounted annual interest rate as low as 1.78%; Citibank has a minimum annual interest rate of 2.01% on tax loans, and eligible applicants can enjoy up to HKD 10,000 in cash vouchers. Of course, to get the best rates, there are certain thresholds so we've simplified it all and analyzed the tax loans on offer this year:

2019 Tax Loan APR Comparison

No results foundTry borrowing a smaller amount or set a higher salary to be eligible for more loans

No results foundTry borrowing a smaller amount or set a higher salary to be eligible for more loansWhat do I need to pay attention to?

Annual Percentage Rate (APR)

The annual percentage rate (APR) is the final interest rate after calculating the interest rate, handling fee and cash rebate, which helps to understand the borrowing cost. APR varies depending on factors such as the loan amount, your credit rating and the repayment period. Not everyone is eligible for the best APR.

Tax loan amount and repayment period

Banks generally provide tax loans no more than to 10 to 12 times your monthly salary. For example, a wage earner with a monthly salary of HKD 20,000 can borrow a loan of between HKD 200,000 to HKD 240,000. The repayment period is generally 12 to 24 months.

Documents required for applying for tax loans

Banks will usually require the applicant to submit your HKID card, proof of address, income proof and tax bill.

Risk of using tax loans to invest

Banks generally do not restrict the use of tax credits so some people may choose to borrow money through tax loans to increase their investment capital. If one borrows tax at a rate of less than 2% per annum, it may not difficult to find stocks, ETFs, bonds, funds and other investment products that are higher than 2%. However, with Hong Kong’s recent economic turmoil, you must pay attention to risks and clearly understand the actual costs and returns of borrowing and investment. If there is a downturn in the market, you may take quite a loss!

The impact of tax loans on your credit score

As with other loans, tax loans will leave a record in the TransUnion credit report and making a large number of applications, being late to pay, or defaulting on your loan will have a negative impact on credit history. Therefore, you must consider the ability to repay before borrowing money and repay on time.

Why do banks offer tax loans anyway?

The annual interest rate of tax loans is generally lower than that of the personal loans. Generally, it works itself out for the banks because loan amounts are limited based on your salary and it gives the bank a chance to acquire "higher quality" customers. It's a great way for them to start a banking relationship with you and, In the long term, provide you with other products in the future!

Disclaimer: The APR includes the basic interest rate, as well as any other fees and charges (i.e.: Handling Fee) so that it reflects the actual total cost of borrowing. The actual APR applicable may differ, please check with the provider to confirm your final APR based on your loan.

To borrow or not to borrow? Borrow only if you can repay!