🎁Virtual Bank Account Opening Rewards 2023

| Bank | Rewards and Eligibility | Reward Value | Deadline |

| Airstar Bank | New customers who open an Airstar Bank account and enter the invitation code [PLANTO] can receive an exclusive HK$100 cash reward from Planto and an additional 2% HKD time deposit interest rate coupon. All customers can enjoy a three-month current account deposit promotion, making the total reward up to HK$520. 👉Open an Account Now | HK$520 | 30/9 |

| livi bank | On or before June 30, 2023, new customers who open a livi bank account using the invitation code 【PLANTO#1000$】 and complete simple tasks can enjoy cash rewards of up to HK$1,000! 👉Open an Account Now | HK$1,000 | 30/7 |

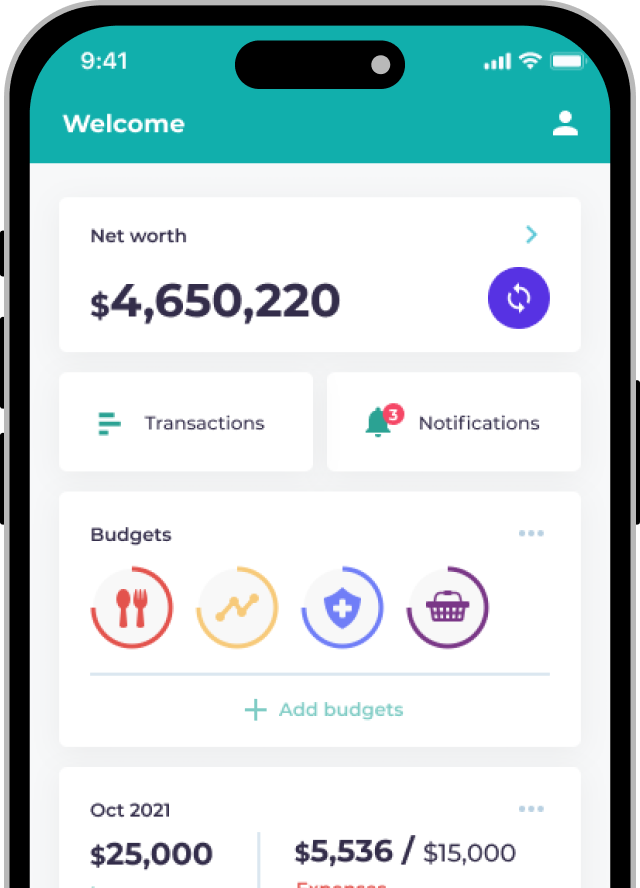

The Hong Kong Monetary Authority (HKMA) issued 8 virtual bank licenses in 2019, all of which have now been fully operational, marking the beginning of the “neo-bank” era in Hong Kong. According to a study published by Visa in October 2021, nearly half of Hong Kong consumers have opened virtual bank accounts.

As the name suggests, virtual banks in Hong Kong are purely electronic platforms operating through websites and mobile applications, offering retail banking services such as deposits, loans, credit card applications, and direct debit cards without needing face-to-face interaction with customer service representatives.

There are 8 virtual banks operating in Hong Kong, including livi bank, ZA Bank, Airstar Bank, Weab Bank, Fusion Bank, MOX Bank, Ant Bank, and PAO Bank. In a highly competitive market, these virtual banks continuously offer rich welcome rewards for new account openings, attractive interest rates for fixed and current deposits, cashback for spending, and low-interest loans, providing Hong Kong citizens with highly appealing digital banking services.

Tips for Choosing the Best Virtual Bank

The products offered by virtual banks are fewer than those offered by traditional banks, and currently, they are focused on a few main services, each with their own selling points.

| Virtual bank | Deposit | Personal loan | Debit card | Insurance | Investment | SME services |

| Airstar Bank | ✅ | ✅ | ❌ | ❌ | ❌ | ❌ |

| livi Bank | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Mox Bank | ✅ | ✅ | ✅ | ❌ | ❌ | ❌ |

| Welab Bank | ✅ | ✅ | ✅ | ❌ | ✅ | ❌ |

| ZA Bank | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Ant Bank | ✅ | ✅ | ❌ | ❌ | ❌ | ❌ |

| PAO Bank | ✅ | ❌ | ❌ | ❌ | ✅ | ✅ |

Enjoy Comprehensive Banking Services?

ZA Bank, Hong Kong’s first virtual bank, offers high-interest deposits, debit cards, personal loans, investment services, credit card repayment, and virtual insurance products under the ZA Insure brand. Its range of products is more comprehensive than other virtual banks, making it the most all-rounded and user-friendly virtual bank in Hong Kong.

Desire High Cashback and Shopping Rewards?

Virtual banks compete fiercely in shopping offers. However, most virtual banks have progressed from the initial stage of offering cashback as a loss leader. To take advantage of the perks, it is imperative to carefully monitor and take note of various promotional campaigns and incentives.

For instance, the ZA Card rewards you with a whopping 11% cashback at selected merchants, while the Mox Credit card offers up to 5% cashback. The livi PayLater Mastercard offers a high cashback rate for online shopping at selected merchants, making it an ideal choice for daily expenses. You can also enjoy short-term promotions virtual banks provide in collaboration with merchants.

The ZA Card’s cashback is credited instantly as ZA Coins, which can be redeemed for cash with just a few clicks on the mobile app. Mox Bank’s cashback is credited daily without any waiting period. On the other hand, livi PayLater offers instant cashback for most transactions, which is way more efficient than traditional banks.

If you prefer credit cards over debit cards, livi PayLater and Mox Bank have got you covered. livi PayLater offers a “buy now, pay later” service, allowing you to use a spending installment plan after shopping without any application procedure. Mox Credit service combines the features of a credit card and a debit card.

Look for High-Interest Savings Accounts?

Digital banks like ZA Bank and livi bank have gamified financial platforms where users can earn higher deposit interest rates by completing various tasks. In addition, Airstar bank offers a whopping 3.6% interest rate for their welcome current account promotion, which is very attractive. If you’re looking for flexibility, livi bank offers a 1% annual interest rate for their current account, making it one of the highest interest rates among banks. With these options, you can maximize your savings potential while keeping your funds accessible.

Need an Online Loan?

livi Bank, Airstar Bank, WeLab Bank, and Mox Bank have all made it possible for individuals to apply for personal installment loans and debt consolidation loans through their online platforms. Moreover, ZA Bank provides a credit card balance transfer loan option. These digital loans typically have lower interest rates and a seamless online application process. These virtual banks’ convenient and hassle-free loan application process is designed to provide customers with a more convenient borrowing experience.

Want to Invest?

Several virtual banks offer high-interest deposit accounts compared to traditional banks, but fewer offer actual investment services. ZA Bank has “ZA One” new stock and fund investment services, which allows users to entrust experts to select, subscribe, and trade new stocks. WeLab Bank has launched the “GoWealth” robo-advisor service, which automatically invests in stocks and bond funds for users at a low fee. livi Bank has partnered with China Life Insurance to launch a savings insurance plan, a stable investment option.

Want to Pay bills or Transfer Loan Balances?

Currently, ZA Bank and Mox Bank both offer bill payment functions. ZA Bank uses “FPS Instant Transfer” to transfer balances instantly, while Mox Bank can pay credit card balances, utilities, and bills from multiple merchants. In addition, ZA Bank has also launched the “Bill Master” credit card bill installment plan, allowing users to consolidate credit card bills from different banks and pay in installments for up to 72 months, which is a relatively low-cost credit card installment plan supporting all mainstream credit cards in Hong Kong.

Want to Buy Insurance?

ZA Bank customers can purchase a wide range of products from ZA Insure, such as critical illness insurance, cancer insurance, heart insurance, and retirement insurance, through the mobile app. livi Bank currently only offers short-term savings insurance plans from China Life Insurance.

Need to Open a Business Account?

For newly established small and medium-sized enterprises (SMEs), opening a company account at a traditional bank is not easy. PAO Bank was the first virtual bank to offer company accounts, and now, Airstar Bank, ZA Bank, and livi Bank have followed. Virtual bank SME accounts are advantageous because they allow SMEs to open accounts online more straightforwardly. Sometimes, they offer better loan and deposit interest rates than personal bank accounts.

Rewards for Debit/Credit Card Spending

At present, ZA Bank, MOX Bank, WeLab Bank, and livi Bank have introduced debit cards, with livi Bank’s livi PayLater Mastercard boasting a “buy now, pay later” feature. Moreover, MOX Bank users can elevate their debit card to a credit card. Each virtual bank provides primary rewards for debit/credit card expenditures, as follows:

| Debit/Credit Card | Spending Offers |

| ZA Card | – Enjoy up to 11% cashback on spending at selected merchants. – Get up to 200% cashback on online and in-store purchases. – Buy one and get one free at designated coffee shops. |

| livi Debit Mastercard | – Earn up to 3% cashback on online shopping. – Enjoy additional cashback at designated merchants. |

| livi PayLater Mastercard | – Get up to 8% cashback on purchases at designated online merchants, with zero handling fees for the first 3 months’ installment. – Enjoy additional cashback at designated merchants. |

| MOX Card | – Get 3% cashback on spending at designated merchants with Mox Credit. |

How to Deposit Money into a Virtual Bank Account?

Depositing money into a virtual bank account is a straightforward process. There are three ways to accomplish this:

- Faster Payment System (FPS): Once you have opened a virtual bank account and registered for FPS, you can transfer funds to your virtual bank account from your traditional bank account by entering your email or phone number.

- Electronic Direct Debit Authorization (eDDA): After linking your virtual bank account with your traditional bank account, you can directly withdraw funds from your traditional bank account through the virtual bank’s mobile app interface.

- Transfer via account number: This is the most traditional way of transferring money, where you input the recipient’s bank account number and transfer the money.

eDDA is the most user-friendly of these three methods, as it requires only a one-time linking of your virtual and traditional bank accounts. Then, you can transfer funds with just one click through the virtual bank’s mobile app.

Who are the 8 Virtual Banking License Holders?

| Virtual banks | Shareholders |

| livi Bank | Bank of China, Jardine Matheson Group, Jingdong Digits Technology |

| Mox Bank | Standard Chartered, HKT, PCCW, Ctrip |

| ZA Bank | Zhong An Insurance, Sinolink Worldwide Holdings |

| WeLab Bank | Welend, Alibaba, TOM Group |

| Ant Bank | Ant Financial |

| Airstar Bank | Xiaomi Corporation, AMTD Group |

| Fusion Bank | Tencent, ICBC, Hillhouse Capital |

| Ping An OneConnect Bank | Ping An Insurance |

Virtual banks vs. Traditional banks: Pros & Cons

As the banking industry shifts towards virtual platforms, the debate over the advantages and disadvantages of virtual banks compared to traditional banks becomes more prominent. Virtual banks, without physical branches, enjoy cost advantages in terms of rent and manpower, and can provide more tailored banking services to enhance user experience.

Advantages of Virtual Banks:

- 24-hour mobile banking: Virtual banks allow customers to access banking services through their mobile phones at any time. They can even remotely open accounts by scanning their ID cards or uploading selfies.

- Low fees: Virtual banks do not set minimum deposit thresholds or charge low account balance fees, benefiting small depositors without minimum deposit thresholds or low account balance fees.

- Increased market competition: Virtual banks offer more incentives to attract depositors, such as canceling low balance fees, increasing deposit interest rates, and credit card spending rebates.

- Promoting technological development: Virtual banks are expected to promote the development of financial services such as mobile banking, virtual credit cards, cross-border payments, and virtual insurance.

- Connecting with traditional banks: Virtual banks can connect with traditional banks through real-time transfers, complementing each other.

Disadvantages of Virtual Banks

However, virtual banks also have some drawbacks that make it challenging to replace traditional banks.

- No physical branches: Although online banking has been mainstream, many customers still prefer to use branch services such as deposits and withdrawals. Virtual banks are inconvenient for elderly customers who are not adept at using technology.

- Fewer choices of product: Most virtual banks currently only offer deposit, personal loan, and payment services and do not provide comprehensive retail banking services like traditional banks that cover investment, mortgage, and insurance services.

- Less personalized service: Traditional banks’ relationship managers understand customer needs through direct communication, while virtual banks rely on customers to complete most services through online systems. This limits the ability to understand customer needs and provide tailored services, which is a significant drawback.

In fact, traditional banks can offer a similar banking experience to virtual banks by actively digitizing their services, and many have already started doing so. For example, HSBC’s PayMe and Citibank’s inMotion are mature digital banking products covering many features and digital experiences that virtual banks do. In response to virtual banks, traditional banks such as HSBC, Citibank, Standard Chartered Bank, Hang Seng Bank, and Dah Sing Bank have canceled various service charges, including low balance fees.

Mobile stock or fund trading platforms like Futu, SoFi HK, and HSBC FlexInvest have already blossomed in the investment field. Even if virtual banks introduce investment services late, they may not significantly impact the market.

Virtual banks have also succeeded abroad. For instance, Monzo was founded in the UK in 2015 and soon became the most famous virtual bank in the world. It features automatic accounting and comprehensive data analysis, among others. In conclusion, virtual banks offer several advantages, but traditional banks still hold an important place in the banking industry due to their extensive range of services and personalized customer service.

Visa Survey: Half of Hong Kong Residents Have Opened Virtual Bank Accounts

According to a Visa survey conducted in July 2021, nearly half of the Hong Kong respondents reported having opened a virtual bank account. The main reasons for opening such accounts included account opening rewards (58%), high deposit interest rates (55%), and a more convenient account opening process (36%).

The awareness of virtual banking among Hong Kong people has also increased from 75% in 2020 to 86% in 2021, with ZA Bank, Ant Bank, and Mox being the most popular. However, 34% of respondents believed that virtual bank accounts are more likely to be hacked, and 31% were concerned about fraud or unauthorized transactions. 80% of the respondents stated they would still use traditional banks as their primary bank accounts. Overall, 61% of Hong Kong residents feel secure when using mobile payments, compared to 28% in 2020.

What Protections are in Place for Customers of Virtual Banks in Hong Kong?

Like traditional banks, virtual banks are regulated by the Hong Kong Monetary Authority and participate in deposit protection schemes. In the event of bank failure, customers are eligible for compensation of up to HK$500,000.

Although virtual banks primarily operate online, they are still required to have physical offices in Hong Kong. Therefore, customers can still access live customer service when they encounter queries or complaints that cannot be resolved online.

In addition, under the Hong Kong Monetary Authority’s strict supervision, virtual banks have established a strong security infrastructure. Biometric authentication and encrypted data transmission are standard practices. Virtual banks in Hong Kong offer further safeguards for their customers. Notably, Mox Bank and WeLab Bank’s debit cards eschew displaying card numbers or CVV security codes, while ZA Bank and Mox Bank have introduced a one-click lock card functionality to mitigate the risk of debit card theft.

FAQ About Virtual Banks in Hong Kong

According to the definition by the Hong Kong Monetary Authority, a virtual bank is a bank that primarily offers retail banking services through the internet or other electronic channels instead of physical branches. The HKMA believes virtual banks can promote fintech and innovation in Hong Kong and provide customers with new experiences.

Licensed virtual banks in Hong Kong include ZA Bank, Airstar Bank, MOX Bank, livi bank, WeLab Bank, Ant Bank, PAO Bank, and Fusion Bank.

The eligibility criteria for opening a virtual bank account vary slightly depending on each bank but mainly require the following:

– Being at least 18 years old

– Holding a valid Hong Kong identity card

– Having a Hong Kong mobile number for receiving SMS

– Having a valid Hong Kong residential address

Deposits to virtual bank accounts can mainly be made through Faster Payment System (FPS), electronic Direct Debit Authorization (eDDA), and account number transfer.

Some virtual banks allow customers can withdraw cash through ATMs. Otherwise, customers have to transfer money to another bank account to withdraw cash.

Like traditional retail banks, all virtual banks participate in Deposit Protection Scheme, and depositors are eligible for up to HK$ 500,000 in deposit protection.