Financial Independence. It is something that we ladies all want and need. Whether it is gender pay gaps or differences in priorities, planning our finances well is crucial for us. According to a study by SCMP, women earn 11% less than their male counterparts in their 30s and the gap increases to 25% at the age of 50. Robert Walters revealed that 56% female professionals slow down work progress due to family pressure and commitments, making it even harder for women to stay ahead of their finances.

It’s a no brainer that we strive for financial independence, but it’s not easy to know where to start.

If you have the budget, one solution for you is to seek a financial advisor. According to a Prudential study, women are more likely to seek help from a financial advisor and with the right guidance, have greater confidence and preparedness to meet their financial goals. Let’s dig more into financial advisors and see if they are right for you!

What are financial advisors?

Financial advisors refer to professionals who provide personal financial advice and insights to help their clients manage their finances at different stages of their lives. Personal financial planning covers wealth management, insurance, investments, taxes, retirement planning and even heritage management, with specialists focusing on specific areas.

What could they do for you ?

Although financial advising services vary, the general workflow for financial planning is similar.

- Goal Setting. A clear goal is important for independent financial advisors and clients to come up with a customized financial plan. Goals varies among people. These could be marriage, flat-purchase, or planning for a baby.

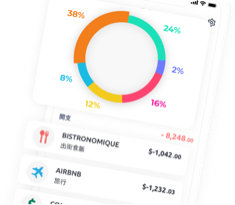

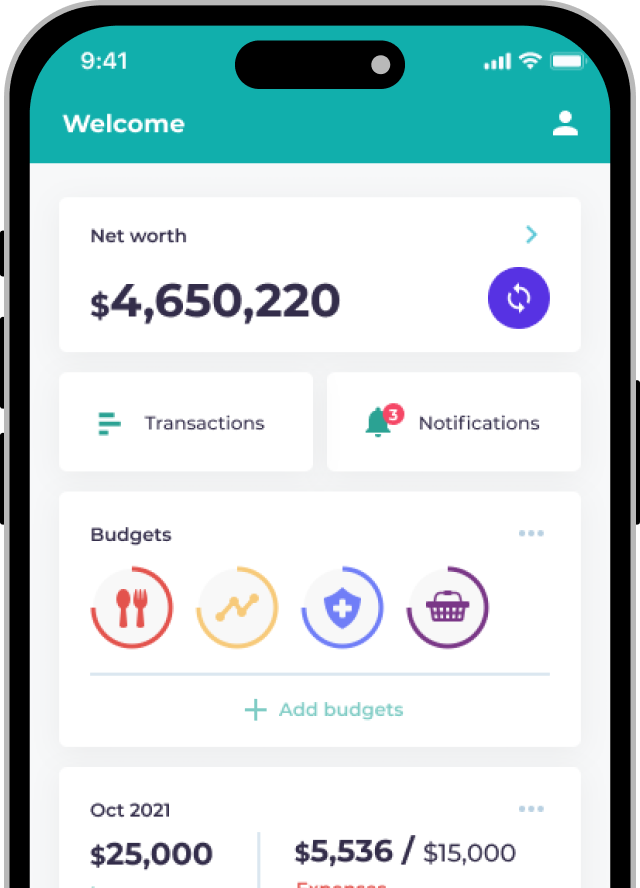

- Analyse. Analysing your finances is another key in financial consultancy. If you are not used to keeping track of your finances, some apps may be handy for you to analyse your spending.

- Plan. With an overview of your finances, your financial consultant can plan ways to achieve your financial goals.

- Act. Here comes the most important step. Act. No matter how great your plan is, it is important for you to take the initiative.

- Monitor. Your financial advisor will be there to keep you on track and watch your progress.

What to consider when choosing a financial advisor in Hong Kong?

There are many financial advisors out there, many of whom provide services via banks. There are also many companies that focus on financial wealth management. Regardless of where you find your financial advisors, always keep in mind the following criteria.

- Qualifications. In Hong Kong, financials advisors can earn a CFP certification to prove their quality. Over 43% HK consumers are "very satisfied" with CFP professionals while half of them stated that CFP professionals are a “trusted source of advice”.

- Scope of service. There are a wide range of financial planning services. Check if your financial advisor provides the service that you want. It is to note that financial advisors in HK are NOT allowed to sell insurance and securities products, or give direct investment advices.

- Financial planning approaches. Every financial advisor work differently. While some prefer a comprehensive plan, some are more attentive to details. Talk to your advisor beforehand to understand their approach to financial planning.

Cheaper alternatives

Hiring a financial advisor can be costly. If you are tight on budget, you can check out free online resources like the The Chin Family or The New Savvy to give you some tips on how to manage your finances better.

For investments, robo-advisors may be an option for you. You just need to answer some questions through an online medium and an AI system will analyse your finances and come up with a portfolio for your goals. Robo-advisors usually cost less than a human advisor. These companies include 8 Securites and Aqumon.

Financial planning is essential. While some of you may have everything figured out, most of us are dazzled by the complexity of the finance world. So, don’t be shy and seek professional help to manage your finances!

![[IWD 2019] Financial Advisor – Do you need it?](https://d3pwh2ime6p0el.cloudfront.net/wp-content/uploads/2019/12/20190311_financial-advisor_1-768x402.jpg.webp)