Asia is seeing the emergence of more digital wealth managers as fintech continues to grow and the region is witnessing more demand from consumers to invest intelligently with AI. One of the most successful digital wealth managers in recent years is Singapore-based StashAway, which just recently landed in Hong Kong. StashAway currently manages more than US$1 billion (HK$7.8 billion) in assets under management as of Jan 2021 and was awarded a Technology Pioneer by The World Economic Forum, a prestigious award whose past recipients included tech giants such as Google, Airbnb, Spotify and Twitter.

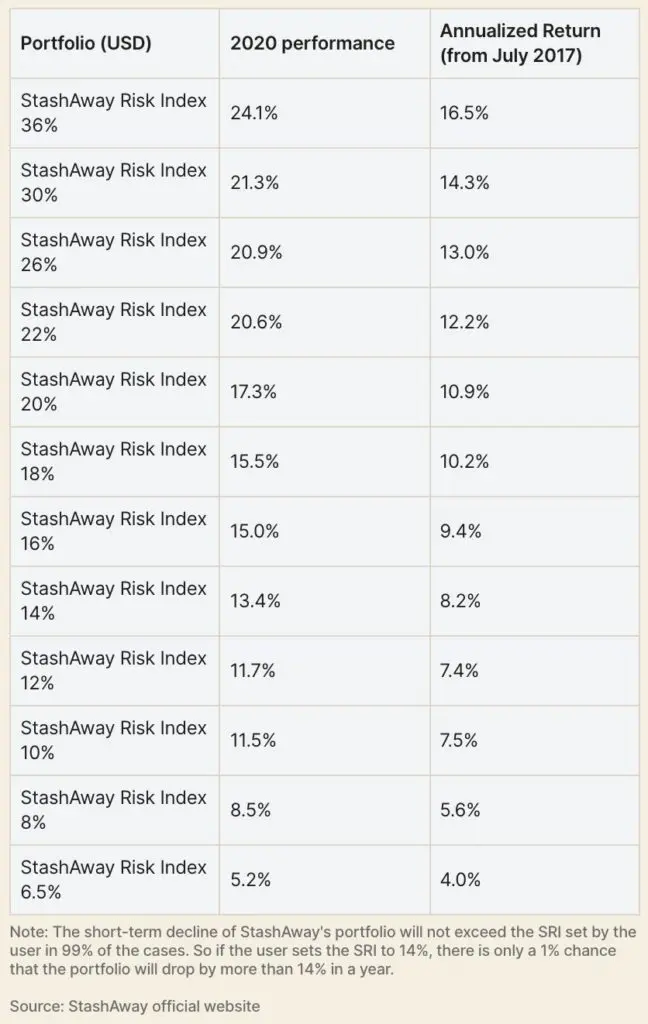

StashAway’s portfolio consists of exchange-traded funds (ETF) that have been vetted by the team, where they monitor data 24×7 within their proprietary investment framework, ERAA® (Economic Regime-based Asset Allocation), to tailor-make portfolios for their customers. ERAA® is a dynamic and highly sophisticated framework, that is typically only accessible to HNW individuals. On the face of it, you may think, “This doesn’t seem so different from other robo-advisors or digital wealth managers”. However, their performance speaks for itself: In the unstable 2020 investment market, StashAway’s best portfolio returned 24.1%; and out of 12 portfolios, 10 portfolios returned more than 10%, with none incurring losses.

In October 2021, StashAway introduced their new thematic portfolios which cover 3 major themes: “Technology Enablers”, “The Future of Consumer Tech” and “Healthcare Innovation”. These cover sectors that are expected to transform, or structurally change, existing paradigms and are major drivers of future growth.

Introduction to StashAway

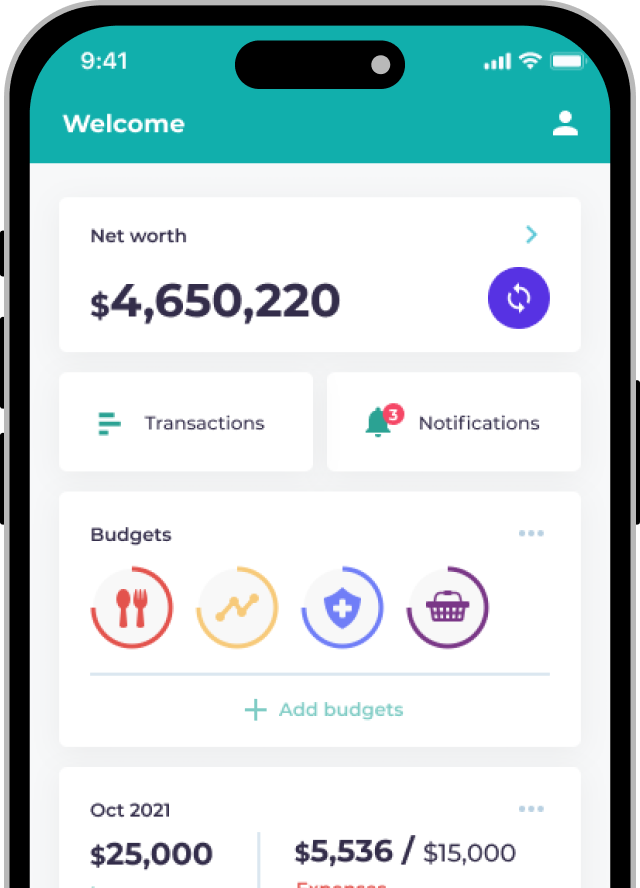

| Portfolios | 12 types of general portfolios & 3 thematic portfolios, covering 50+ US ETFs, 14,000 securities assets and 20 different markets |

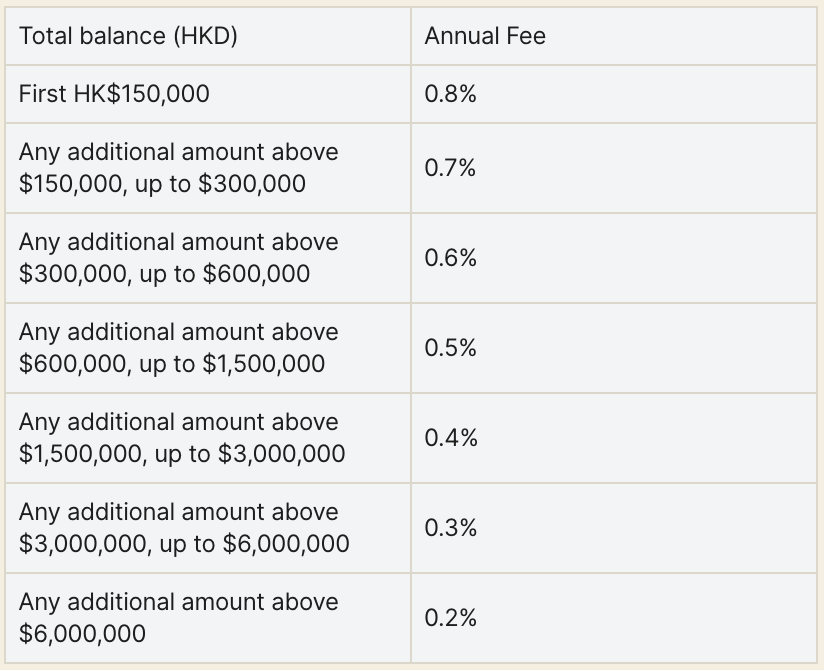

| Fees | Annual fee is 0.2-0.8% of the total assets. Open an account via Planto and enjoy the services free for 6 months! |

| Account opening funding requirements | HK$10,000 (SFC requirement) |

| Licensing and Supervision | Hong Kong Securities Regulatory Commission Type 1 (Securities Trading), Type 4 (Advising on Securities) and Type 9 (Providing Asset Management) Licenses; Central No.: BQE542 |

| Platforms Supported | iOS, Android, Web |

| Year of establishment | 2016 |

| Operating markets | Hong Kong, Singapore, Malaysia, Middle East and North Africa |

| Investors and Investment Amount | USD61 million from 8 + investors including Sequoia Capital, Square Peg Capital and Eight Roads, Fidelity’s Private Equity and Venture Capital arm |

Simple and intuitive UI/UX

StashAway’s user interface is simple and intuitive. Regardless of whether you’re a beginner or an experienced investor, users can easily allocate their assets and start investing. In other words, consumers don’t need to struggle with picking stocks, read overly complicated financial documents or monitor their portfolio 24/7 — StashAway will do all the hard work for you. Market trends and all investment decisions are handled by StashAway’s algorithmic trading systems, making their investing experiences hassle-free and convenient.

How do you know that your money is in good hands? In addition to the algorithmic trading systems, StashAway’s investment committee is made up of highly experienced investment professionals who have managed multi-billion portfolios for decades.

There are three ways for users to invest through StashAway:

Thematic Portfolios

StashAway offers 3 different themes from which users can choose from: Technology Enablers, The Future of Consumer Technology, and Healthcare Innovation. These portfolios feature ETFs from the leaders in thematic investing which includes ARK Invest, iShares, Global X, and many more.

- Technology Enablers: Artificial Intelligence, Blockchain, Cloud Computing, Robotics, Semiconductors

- The Future of Consumer Tech: E-commerce, Fintech, Gaming, Internet, Future of Mobility, Social Media

- Healthcare Innovation: Biotech, Genomics, Medical Devices, Pharmaceuticals

After selecting your theme, you can customize your risk appetite. StashAway reminds users that thematic investments have high short-term volatility and should be viewed as long-term investing. The recommended investment period is 5 to 7 years.

When setting the theme for their portfolios, users can view the breakdown of each portfolio and set their StashAway risk index to ensure that the risks and growth potentials are in line with expectations.

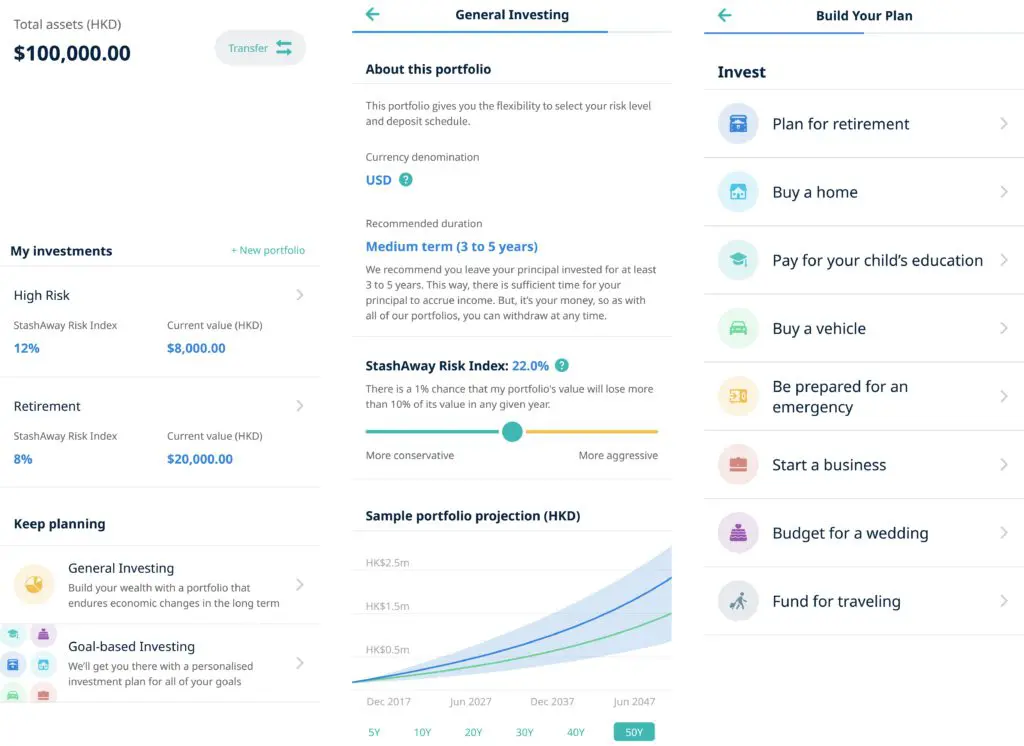

General Investing – Risk exposure selection via StashAway Risk Index (SRI)

Users can have their portfolios tailor made based on their risk preferences based on the “StashAway Risk Index” ( “SRI”). SRI ranges from 6.5% to 36%. Unlike the standard 3 options: conservative, balanced, aggressive elsewhere, SRI provides 12 options for customers to choose from. Assuming you chose a 26% SRI, it means that your asset portfolio only has a 1% chance of having a drawdown of more than 26% of its assets in a year.

The SRI is something that is truly proprietary to StashAway- their portfolios are managed in a way so that the SRI stays constant in bull and bear markets.

Goal-based Investing

The user first selects a goal, such as retirement, buying a house, buying a car, getting married, or starting a business. Take buying a house as an example. After you fill in basic in information such as target date of purchase, location, first installment, etc., StashAway’s algorithm will recommend the appropriate investment portfolio for you to reach your financial goals on schedule, taking both inflation and capital growth into consideration.

Thereafter, StashAway will build the portfolios consisting of the relevant ETFs, and the system will continuously monitor market conditions, as well as make the best data-based adjustments to positions in a timely manner, with no adjustment fees being charged.

Users can check their portfolios any time, have access to current market insights from their CIO office, as well as financial education videos for free.Users can also readjust their risks according to their own preferences.

Highly Transparent, Stable and Strong Returns

Before the advent of robo-advisors and digital wealth managers, many investors “outsourced” their decision-making process to experts from fund companies. Although it saved investors time and energy, traditional investment advisors had low transparency, unstable performance, and high fees.

Compared with investment experts who are very secretive about trading strategies, StashAway offers a high level of transparency. Users can see down to the exact ETF holdings within their portfolios on their App.

As seen from StashAway’s website, the selected securities are low-fee U.S. ETFs, with an expense ratio ranging from 0.04% to 0.76%. The investment scope covers markets in the United States, Canada, Europe, Japan, and China, spanning sectors such as technology, energy, medical, financial services, telecommunications, consumer goods. These carefully selected ETFs are all promising investments from large investment institutions, and do not involve high-risk leveraged or inverse products, which shows that the platform focuses more on medium to long term returns.

Now, you may wonder, why can’t investors just buy all the funds disclosed by StashAway by themselves? The answer is very simple: human investors, especially novices, can never monitor the market 24/7, and it’s difficult for humans to rationally invest and rebalance in such a volatile market. StashAway provides an easy way for people to invest systematically through a intelligent investment framework that ensures diversified investing for the medium to long term.

StashAway also supports fractional shares, so it can easily allocate assets according to an investor’s budget and risk appetite. Even if the price of individual assets increases, you can still enter the market with a low threshold with fractional shares.

In fact, StashAway’s portfolios have performed well in the past few years:

A Wealth of Free Resources Around Financial Management

Although with StashAway, there is a smart robo-advisor managing your portfolio, they still recognise the importance of learning the basics of investing and financial management for personal growth. In addition to their robo-advisor services, StashAway also provides a plethora of educational content around investing and personal finance which are created and conducted by a team of experts, which are published as articles, videos, Podcasts on Spotify, Webinars, etc. – all for free!

One of their most popular platforms is their StashAway Academy, which currently has curriculums on on personal finance management which covers topics such as:

- Basic courses: Financial Planning Basics, Investing Basics

- Intermediate courses: How to Invest (The Right Way) with ETFs, How to Plan for Your Retirement

- Advanced courses: A Deep Dive into StashAway’s Asset Allocation Investment Framework, What is your Financial Plan B?

- Electives: StashAway: An Inside Look, How to Start a Business…That Lasts

StashAway account opening steps and fees

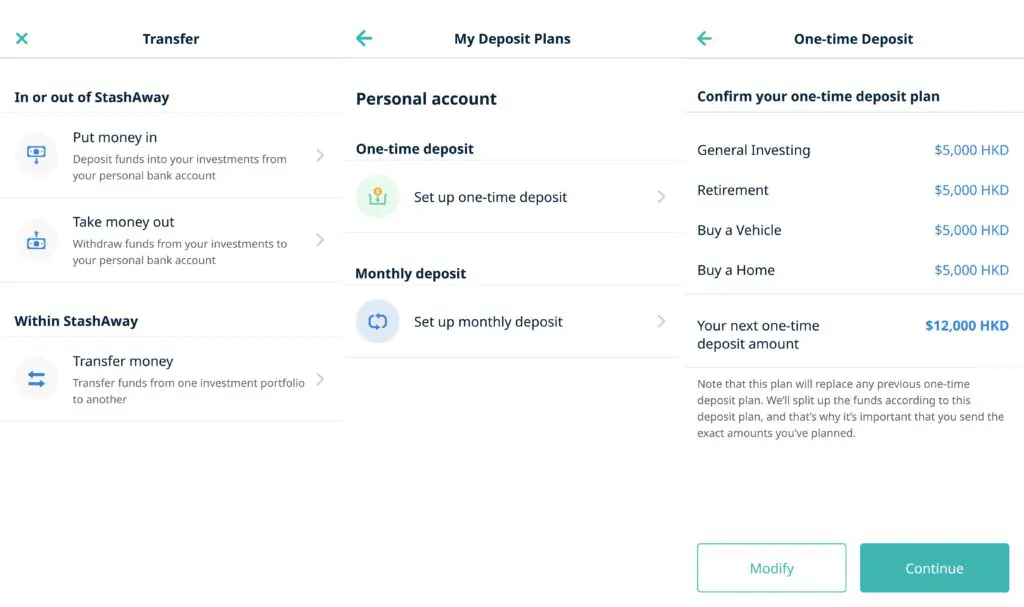

StashAway has a fully online account opening service which is simple and so fast, you can be done within a few minutes. Users can choose to deposit funds once, or deposit funds every month.

Opening an account is easy with StashAway. It simply required you to complete a few steps before starting to invest in HKD and USD.

- Download StashAway

Download the iOS or Android mobile app, or open an account through their website

- Complete your personal and basic financial information

Set up an email and password, and provide your basic personal and financial information

- Upload files

You can upload your ID card and proof of address right away, or submit them via WhatsApp later

- Build investment portfolios and deposit funds

The StashAway system will create a portfolio based on the information you provided as well as your risk preferences, and after confirmation, you can easily deposit the funds via FPS or bank transfer.

- Start investing

StashAway will automatically monitor the performance of your portfolios and adjust your positions based on the market and your goals. You can also change your risk appetite or investment objectives at any time

StashAway also has a strong customer service team who are available to answer customer inquiries via WhatsApp, Facebook Messenger, phone, and email. Their customer support is available 7 days a week and normally picks up the phone within 8 seconds during business hours.

StashAway Fees

StashAway fees are very simple, they only charge a single, all-inclusive management fee based on the asset under management. There are no account set up or exit fees and users have unlimited free withdrawals and unlimited free transfers between portfolios.

What type of investor is best suited to use StashAway?

StashAway provides diversified portfolios which are suitable for both experienced investors and beginners. Their past records have shown their strong annual return, where their focus is on the medium to long term. As their portfolios are ETF based, it still has its limitations as users cannot buy single stocks and capture relatively short term explosive growth opportunities like the ones we’ve seen in 2020 and 2021 related to tech, crypto and vaccines stocks.

Regardless, many studies have pointed out that long term focused investments often perform better than those that are short-term speculations.

In all, even though you may be using other investment brokerages to buy and sell your self-picked stocks, a robo-advisor like StashAway is a great choice to easily diversify your portfolio and achieve stable returns. This is especially helpful if you’re a novice investor or a busy office worker who doesn’t have the time to research and manage your finances actively.

Discover the Best Investment Account Fees and offers

Important information:

Investment involves risks. This information is intended to be educational and is not tailored to the investment needs of any specific investor. This information does not constitute investment advice and should not be used as the basis for any investment decision nor should it be treated as a recommendation for any investment or action. Past performance is no guarantee of future results. The value of investments and the income from them can go down as well as up, so you may not get back what you invest.