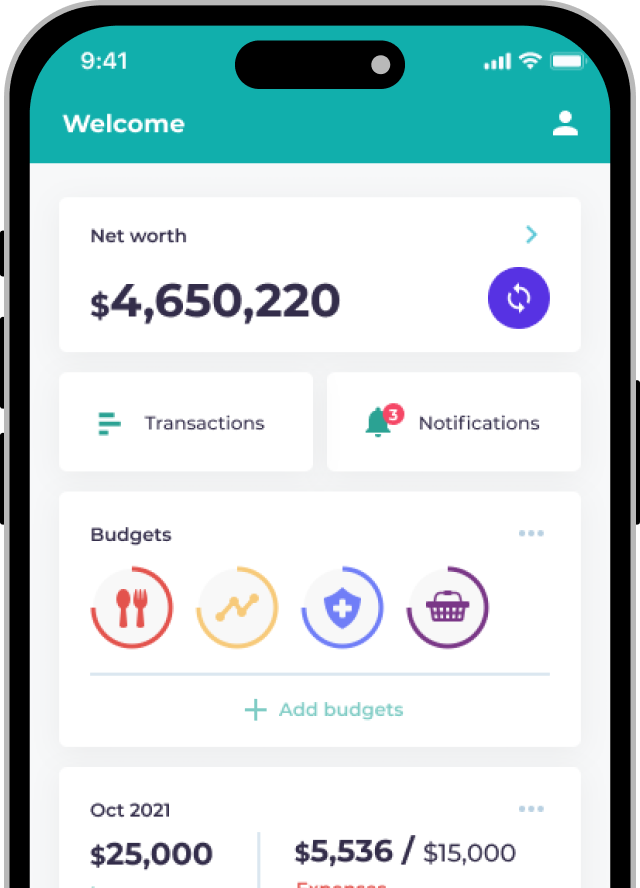

It’s a very common statement that I don’t invest because I don’t have enough money. Several years ago, this may have been true when you needed to have a large amount of money to buy Hong Kong stocks or to open an investment account.

This has changed recently – here’s three ways you can start investing with as little as HKD 1,000:

1. Invest with a Robo-Advisor

Robo-advisors are automated investment consultants. These are companies that will help you invest by picking ETFs and stocks for you. They have very low minimums and it’s quite simple to set up an automated investment plan so you don’t have to think about it. We compare the major robo-advisors here – Chloe and Kristal let you start with as little as HKD 1,000!

2. Buy ETFs

ETFs are very similar to mutual funds except you can buy them on the market like a regular stock. The advantage of ETFs are that they can represent either a geography (like US or China, etc.), a sector (like Financial Services or Technology, etc.) or even an investment approach! A comprehensive list of ETFs can be found here.

You’d have to open a US investment account in order to access most ETFs and given there’s no lot size restriction, you can buy just 1 stock of an ETF too! Luckily, opening a US account is quite easy with the low-cost brokers available in Hong Kong.

3. Get a Monthly Investment Plan

This is what people are most familiar with – banks often provide Monthly Investment Plans which can seem like an easy way to get started investing with a small amount of money. However, it’s not that simple: most banks will charge you a transaction fee for each stock you purchase every month and these costs add up really fast.

Example: Lets say you’re buying 5 stocks a month, contributing HKD 2,000.

If you were using the Monthly Investment Plan offered by BOC or Hang Seng, you would be paying min. 50 HKD per stock which means a minimum of HKD 250 per month to buy your stocks!

This is: HKD 250 / HKD 2000 = 12.5% in fees

In order to accommodate for this, you may think you can just invest more but the cost remains really high. If you’re looking for a Monthly Investment Plan, going for a bank would not be advisable. Luckily, some investment brokers like uSMART offer affordable monthly investment plans which could be a consideration:

Takeaways

Starting to invest doesn’t mean you have to wait until you have a large amount of money saved up. In fact, investing a consistent amount each month over a long period of time is the surest way to build your wealth. Whether you prefer do-it-yourself investing via ETFs and monthly investment plans, or if you want a robo-advisor to do it for you – there’s many options to invest even if you aren’t saving a huge amount each month.

Important information:

Investment involves risks. This information is intended to be educational and is not tailored to the investment needs of any specific investor. This information does not constitute investment advice and should not be used as the basis for any investment decision nor should it be treated as a recommendation for any investment or action. Past performance is no guarantee of future results. The value of investments and the income from them can go down as well as up, so you may not get back what you invest.