Your questions:

Where do I begin?

What can I afford?

Where to start looking?

How can I borrow and who do I borrow from?

What are the legal considerations?

What are the risks?

Time is precious, especially in this busy and competitive society we live in. Planto is here to turn your aspirations of owning a home into reality. We will help you save time and money in making one of the most important decisions in your life.

Where do I begin?

Buying a home is one of the most important decisions in anyone’s life. It embodies the promise of individual autonomy and can be extremely rewarding financially and psychologically. However, high rewards come with high risks, and extra care in planning towards this goal is critical in your homeownership success and thus your overall welfare. To start with, you need to identify your essential needs which is highly dependent on where you are in life. However, 3 universal considerations are:

-

Understanding the purpose of your house: It is not unusual for people to purchase or plan towards home ownership due to social influence. However, not having a clear goal can stop you from making the right decisions or picking a property that is optimal for you in the long term with respect to your quality of life. These include understanding how you plan to use the home (live there? rent out? or both?) and if do you decide to rent, how much rental income do you expect and whether it will be easy for you to lease out your property at an ideal price. Some people also use property as an investment for capital appreciation. In such a case you will need to understand the time horizon you may want to invest towards your house and understand the macroeconomic implications of the property market. In addition, your decision can also impact the mortgage plans you are applicable for. The Hong Kong Mortgage Insurance Plans (MIP) provides loans up to value of 80% – 90% if you plan to buy your first house for self use.

In short, you need to be honest with yourself.

-

The Location: Location, location, location. The conditions of your home can change, but the location never will. It is important for you to list out your lifestyle requirements then choose locations that meet them.

“How long am I willing to commute to work?”

“Will it be convenient for the kids to go to school?”

“Do I need supermarkets and restaurants within the vicinity?”

“Is your location preference dependent on the parents of your significant other’s place of residence?”These are some questions you need to ask yourself.

-

The Number of Rooms / Size: It is pretty self explanatory that the number of rooms depend on how many people will be living in your property, especially in the long term.

However, there may be circumstances where some may not be able to afford to buy the required number of rooms in their ideal location. An alternative is for you to buy a property as an investment to lease out and rent another premise that is more ideal for you, where the rental income covers your rental expenses. In this instance, the number of rooms for yourself does not matter as much as the number of rooms that is most ideal for rental returns. Although, if this is your first house, this option impacts your qualification for Hong Kong Mortgage Insurance Plans which requires the buyer to buy their first house of self use.

If you are flexible in your investments and are able to look beyond deliberate needs, another alternative can be to purchase a property that has more bedrooms than needed and rent it out to cover some of your mortgage expenses, but only if you are fine with having a housemate! Make sure you do the calculations and find the right number for yourself.

In addition, there are other important things to note depending on which life stage you are in.

A University Graduate

As a fresh graduate, you possess the most precious commodity when it comes to buying your first home; time.You have the luxury of researching the type of home that is most ideal for you, following the market closely and understanding when to buy. For example, aside from looking for private properties you may consider public housing if you are eligible, as you are more likely to be open to being on the waitlist for a couple more years.

Additional factor to consider:

Length of stay: If you see yourself moving elsewhere in the foreseeable future due to changes in life plans, it would be better to focus on the rental opportunities or capital appreciation of the property so you are able to get future monetary returns.

Planning for marriage/Newly Married

As a newly wedded individual, it is likely you will have to make the decision based on long term factors like having kids, a domestic helper or a parent living with you. Your priorities will be less on the investment side and more on fulfilling the needs of your family.

Additional factors to consider:

Whether to buy your first property in a single name or joint name: Owning a house with your significant other will undoubtedly give a sense of intimacy for both parties. However, if you are planning to buy a second house in the future, you will have to pay a Double Stamp Duty (DSD) equivalent to 15% of the purchased price. Therefore, buying the first property under individual ownership could be a wiser choice unless you are certain you will not be buying another property.

Going / Planning to Have Kids

As a to-be parent, your circumstances have become definite and your needs in buying a home will be focused on those of your family’s rather than your own. These Include:

Security and Safety: Probably the most important thing for a family with children. These include whether the building has a security guard, CCTV, smart card access and a history without burglaries. We also suggest extra due diligence on the history of the estate, checking whether it is haunted or if there were any past mismanagement.

The neighbourhood: As a parent, you will need to know whether the estate has a family oriented community that has baby friendly facilities. You may also consider if there are appropriate kindergarten/schools within the vicinity to make commute less of a hassle for your children in future.

Helper’s Room: Around 30% of total households with children have at least 1 domestic helper in Hong Kong. This is due to the fact that most parents still continue to be in the workforce after a birth of a child and domestic helpers are affordable for middle to high income families. By law, it is required that full-time domestic helpers live with their employees. As such, if you do decide to employ one, you need to make sure that you have an extra room.

School Nets: There are 36 school nets in Hong Kong. Whilst many prominent schools concentrate on several nets, some nets provide less ideal choices. For instance, Net No.11 (Central, Sheung Wan, Sai Ying Pun, Shek Tong Tsui, Kennedy Town, The Peak) is traditionally regarded as one of the best and most popular among all. In this case, the location of your property will be critical if you want your child to go to more reputable government/government subsidized schools.

What can I afford?

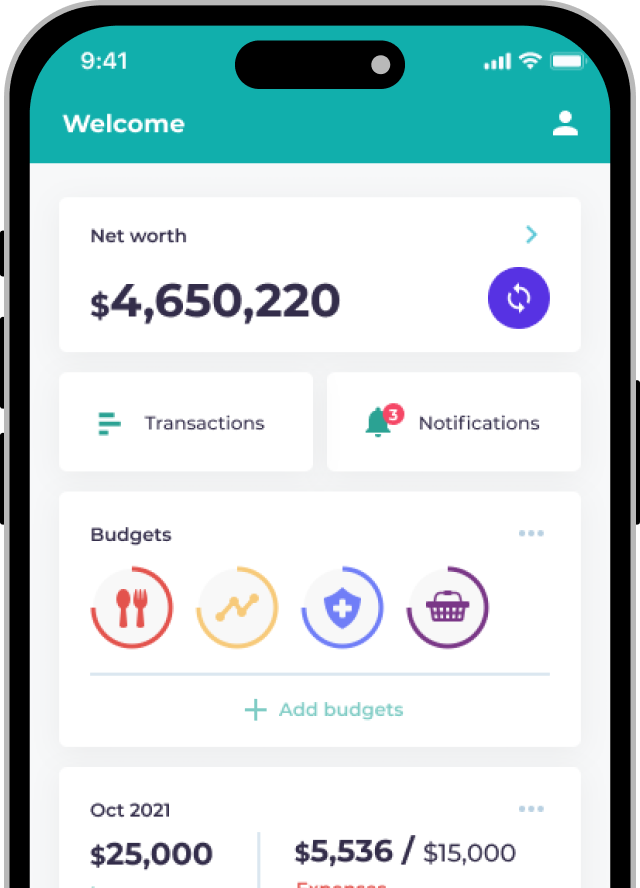

Ever find it difficult to fully understand what the entire cost of buying an apartment is? Or what you can afford ? We certainly have and know it is a real hassle. Planto is developing a modern goal planning platform which also includes an extensive home purchase planning journey that will help you visualize a home according to your preference then check affordability based on important variables and comprehensive financial simulations. It is made simple just for you, register for early access at https://www.planto.hk/

Our simulation takes into account of inflation, salary increase and the all in costs of buying an apartment including:

- Agency fees

- All relevant stamp duties

- Principal and interest payments

- Legal fees

- Mortgage insurance (for those who borrow a loan over 60% Loan-to-Value Ratio)

Where to start looking?

Starting the house hunting journey can be difficult due to a plethora of information online. We have consolidated the top sources to ease the process and listed out their pros and cons, from our views.

Agents

Below are the top property agencies in Hong Kong including their respective recognitions from Squarefoot, a leading media brand in Hong Kong focusing on providing property information from 2010 to 2017:

- Century 21

- Centaline Property

- Hong Kong Property

- Midland Realty

- Homelife Property Consultants Ltd

Pros:

- Convenience: Once you are assigned to an agent, they can assist with filtering properties that fulfill your needs, arrange viewings and guide you through the purchasing process.

- Expertise: They are able transfer knowledge about estates, district, regulations and important concerns that you may have neglected.

- Assist with negotiations: If you are not much of a negotiator, the agent can do this on behalf of you, at times not only limited to price.

Cons:

- Potential bias: There exists the likelihood of conflict of interest as agents are usually paid 1% of total sales price for commision from both buyers and sellers. As such, they may see an incentive to promote pricier properties.

Online platforms

If you are looking for a comprehensive list of properties available, you can search for online platforms such as Squarefoot , Spacious and Gohome, which are easy to navigate.

Pros:

- Comprehensive list of properties: Online platforms showcase properties from both individual sellers and different property agencies. It would be a good starting point for understanding what is really out there and get the gist of the market.*

- Direct access to sellers*: If you want to save a bit of cash (well, not just a bit) and you are pretty good at reading people, then online platforms are your way to go. Beware though, you need to be extra careful and do your own due diligence on the seller and property.

Cons:

- Self service: Whilst online platforms offer guides and blogs, they are less likely to go beyond what is already offered and you will need to manage follow up actions yourself.

Additional Factors to Consider:

Pseudo or outdated listings: It is not uncommon that the properties listed on agencies’ websites or third-party online platforms are already sold or never existed at all. In some cases, the house price listed online are significantly lower than its real selling price in order to attract potential customers. Make sure you manage your expectations and do not be misled by the information.

Property Valuation: Before making a decision to buy a property, you should validate its value evaluated by banks to see how realistic the prices offered are. This can be done through online valuation tools provided by major banks such as HSBC, DBS, BOC or Hang Seng or through phone calls to their hotline. The valuation will also affect whether you are able to apply for a mortgage.

How can I borrow and who do I borrow from?

Three main principles to follow:

- Pay all your debts or minimize your debts to be applicable for most mortgages

- Ensure your credit score is good (you may refer to Transunion)

- Shop around banks or visit a Mortgage broker to get the best interest rates

Lending companies scrutinize the financial health of their applicants carefully through assessing their income and outstanding debt to assess whether one is qualified for a mortgage. They also look at the value, type and age of the property. It is important that you are aware of the basic requirements such has having a steady income and not having too much debt when you apply (in fact, you should try and pay-off all your debts before you lend more). The Hong Kong Monetary Authority (HKMA) has set out the Loan-to-Value Ratio (LTV) caps and Debt Servicing Ratio (DSR) limits for property mortgage loans. Planto’s platform makes this job easier for you by modelling these rules as part of the simulation. For more information, click here

The general rule of thumb is the more risky (more borrowings or weak financial health) you are the more likely an institution will charge a higher interest or reject you. Banks are the most risk averse amongst lending bodies whilst property developers offering general financing plans for new flats are more open to lending at a higher risk, albeit at higher interest rates. Be sure to do additional research on which borrowing scheme is more appropriate for you.

Aside from banks and property developers you can also borrow from lending companies which are in between banks and property developers in terms of risk averseness.

What are the legal considerations?

Do not rush into committing to buying a property after you make a decision. Be sure to hire a solicitor and do your due diligence of the property so that you are well informed of the vendor’s title and encumbrances against the property. As advised by the Hong Kong government, you should be concerned about:

- Whether the vendor is selling the property in the capacity of the owner

- Whether any approval/consent from the Government or other authorities are required before the vendor can sign an agreement to sell the property and whether any premium has to be paid (e.g. flats under the Home Ownership Scheme require owners to pay a premium to the Hong Kong Housing Authority for the removal of the alienation restrictions before they can sell the flats in the open market).

- Whether there are any subsisting mortgages, charges, government orders, tenancy agreements, etc. associated with the property

- If you can obtain a warranty from the vendor that guarantees neither the property has any illegal structure nor has it been altered

- Whether the vendor is able to repay all outstanding debt before the completion of transaction

Important legal documents you will need to sign include:

- Provisional Agreement for Sale and Purchase

- Formal Sale and Purchase Agreement

- Assignment Deed and Legal Charge

In most cases, after signing the Provisional Agreement for Sale and Purchase Agreement, the formal agreement would be signed within 14 days, and the deal would be completed in 45/60/90 days. The schedule of completing the deal is decided upon agreement between the buyer and seller. Please make sure you have enough time to apply for the mortgage and deal with all necessary legal processes.

What are the risks?

The only thing that is constant is change. The rise or fall of your home valuation is dependent on the real estate market and many other variables such as district developments, interest rates and environmental changes.

Before buying an apartment you need to make sure that you are able to carry the financial burden of owning a home during worst case scenarios such as a significant drop in valuation and the sudden inability to pay back mortgages. A good practice is to assess whether you have a backup plan when these situations arise. Need help with assessing whether it is realistically possible for you to pay back your mortgage debt? Planto, your automated goal planning platform, will help you visualize this against your future goals. Make sure you sign up for early access!

If you don’t plan well and end up not being able to bear the consequences, there will be negative psychological impact to you and your family. Don’t take the advice of ‘To borrow or not to borrow? Borrow only if you can repay!’, lightly.

Reach out to us

Find this home purchasing guide helpful? Or did we miss anything? write to us at hello@planto.hk to let us know your opinion, request for additional contents or early access to Planto's comprehensive home purchase planning platform.

About Planto

Planto is a fast growing startup incubated at the University of Hong Kong Entrepreneurship Center, with additional supports from Cyberport, and an experienced group of investors and advisors from Hong Kong, the UK and Canada to assist Hong Kong consumers in achieving their life goals. Visit us at www.planto.hk.