Navigating countless fund options often requires investors to invest significant time in detailed product analysis and selection. As Asia’s leading online wealth management platform, Endowus introduces a novel user experience, pioneering an operating model that forgoes sales commissions. With their proprietary “SMART+ framework” for fund selection, Endowus provides users with fair, reasonable costs and professional investment choices.

As one of the largest independent wealth management companies in Asia, Endowus currently manages assets totaling over US$5 billion (HK$39.0 billion), offering its clients institutional-grade investment opportunities and benefiting from institutional-grade fund fees and zero subscription charges.

Catering to diverse investment objectives, Endowus created the “Fund Smart” platform, selecting over 200 high-quality funds from thousands, spanning cash and money markets, fixed income, equities, multi-asset, and commodity markets. Over the past year, more than 80% of the funds chosen by Endowus have recorded positive returns, with some funds even gaining over 20%.

Endowus innovatively forgoes sales commissions from fund providers. This not only helps investors save costs but also ensures Endowus can professionally and impartially offer high-quality products to clients unaffected by product commissions. Currently, Endowus’s average fund fee is only 0.84% per year, saving users up to 70% in investment costs.

Speaking of user experience, Endowus offers an easy and flexible investment service. Users can construct their investment portfolios with single funds, or choose from ready-made, multi-fund “model portfolios” designed by Endowus’ team of investment experts. The model portfolios are designed to suit different investors’ risk tolerances, asset allocations, and investment goals. Endowus offers core portfolios such as “Passive Income”, “Global” and “Cash Management”, as well as satellite portfolios including “China Equities,” “Sustainability – Equities,” “Future Trends,” and “Global Technology”. The satellite portfolios can be suitable for investors who wish to seize investment opportunities in popular sectors.

Moreover, Endowus offers a private-market investment service catering to professional investors (those with HK$8 million liquid assets or above), enabling them to access institutional-grade private equity, private credit, hedge funds, private real estate, and other alternative investment products.

An Overview of Endowus

| Fund Products | – Endowus Fund Smart (200+ curated, high-quality funds from world-renowned fund houses) – Core model portfolios – Satellite model portfolios – Alternative investments |

| Fees | Annual fee averaging 0.1% to 0.6% of total investments |

| Account Opening Funds Requirement: | HK$10,000 (as required by the HKSFC) |

| Licences and Regulation | Type 1 (Dealing in Securities), Type 4 (Advising on Securities), and Type 9 (Asset Management) regulated activities from HKSFC; CE No. BQR225 |

| Year of Establishment | 2017 |

| Operating Markets | Singapore and Hong Kong |

| Cornerstone Investors & Investment Amount | A group of 10+ investors, including UBS, Citi Ventures, MUFG Innovation Partners, EDBI, and SoftBank Ventures Asia, have invested over US$95 million to date. |

Users can seamlessly purchase their desired fund products and complete their asset allocation by logging into the Endowus platform website and following the easy-to-understand instructions. Endowus’ professional team selects more than 200 high-quality funds from thousands of options, saving you substantial screening time. It is straightforward for both seasoned investors and beginners.

Endowus’ investment team is led by Endowus Chairman and CIO Samuel Rhee, who is ex-CEO and CIO of Morgan Stanley Investment Management. Under his leadership, the team possesses diverse expertise and experience, gaining the trust and recognition of numerous investors. Combining experience with technology, Endowus provides various investment offerings based on users’ needs:

Endowus Fund Smart

The investment team at Endowus meticulously selects more than 200 fund products from thousands of options based on their proprietary “SMART+” framework. This process involves screening, measuring, assessing, refining, and tracking the funds under multiple layers of scrutiny. Investors can easily browse through these top-tier funds via the Endowus Fund Smart platform.

The funds are managed by more than 40 leading global fund companies, including Allianz Global Investors, BlackRock, Fidelity, Franklin Templeton, Goldman Sachs Asset Management, JP Morgan Asset Management, PIMCO, and more. The geographies span the U.S., Europe, Asia, Japan, China, and other markets, and cover a diverse range of sectors including technology, energy, finance, thematics, and consumer goods. Users only need to consider the asset class, region, industry, or theme they wish to invest in to find a fund product that meets their needs.

0% subscription and transaction fees

Low investment cost is the key to success in investing. With 0% subscription and transaction fees, Endowus only charges a transparent, all-in Endowus fee and rebates 100% of sales commissions to customers, which saves up to 70% of investment costs for investors.

Take the Blackrock BGF World Technology Fund as an example. As of 21 July 2023, the fund’s performance gained +24.3% year-to-date. If purchased through a retail bank or other online platforms, the total fund fee plus additional subscription and sales charges could range from 1.82% to 3.82% per year. However, on Endowus Fund Smart, the total cost of the same fund’s institutional share class is only 1.07%.

Endowus charges an annual advisory fee of 0.40% for investments under HK$20 million. Adding in the fund’s own costs, the total cost is just 1.47% per year, which is close to half of the prices on other platforms. Since 2019, Endowus has saved clients over US$20 million in investment fees. Users pay less in investment costs while directly investing in high-quality fund products.

Not only does Endowus not charge any subscription fees, it also rebates all the sales commissions received from fund managers. The benefits extend far beyond saving transaction costs for customers. Traditional financial advisors, private banks, and other asset management platforms often depend on sales commissions paid by fund companies for profits. This can lead to salespeople recommending products that may not be in clients’ best interest in pursuit of high commissions.

Endowus’ zero-commission model allows it to provide investment products and advice without being swayed by product commissions, ensuring it can select products that best meet investor needs and interests. Furthermore, Endowus complies with the SFC Conduct Rule 10.2, identifying itself as an independent financial advisory platform, reflecting its professionalism and objectivity.

Endowus Fund Smart offers a large selection of high-quality and low-fee funds:

| Funds | Past 1-Year Performance | Fund Level fees after Cashback |

| Blackrock BGF World Mining Fund | +22.62% | 1.31% |

| Fidelity Global Technology Fund | +21.57% | 1.03% |

| Harris Associates U.S. Value Equity Fund | +18.54% | 1.05% |

| Goldman Sachs Asset Management Japan Equity Partners Portfolio Fund | +18.31% | 0.74% |

| Blackrock BGF Sustainable Energy Fund | +17.64% | 1.22% |

| T. Rowe Price US Large Cap Growth Fund | +17.02% | 0.70% |

| BGF World Technology Fund | +16.24% | 1.07% |

| Jupiter European Growth Equity Fund | +16.33% | 1.02% |

| Allianz Global Investors Global Artificial Intelligence Fund | +14.77% | 1.23% |

| Abrdn European Sustainable Equity Fund | +14.64% | 0.94% |

| Blackrock BGF Future of Transport Fund | +13.94% | 1.00% |

Model Portfolios

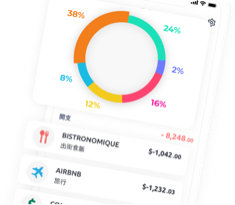

Not sure which fund to buy? The Endowus “model portfolios” are multi-fund investment portfolios carefully designed by Endowus’s investment research team, including major portfolios such as: “Cash Management,” “Global,” “Passive Income,” “China Equities,” “Future Trends,” “Global Technology” and “Sustainability – Equities”. Investors can either use the portfolio as it is, or adjust the portfolio’s asset allocation or underlying funds according to their wealth goals and risk tolerance, further customizing a suitable asset allocation plan for themselves.

▲ In the “Global” portfolio, users can adjust the allocation of stocks and bonds according to the risk they can bear.

Satellite Portfolios

For those who already have a basic allocation of assets and want to set up a core-satellite investing strategy, Endowus has also taken into account their needs. The satellite portfolios, “China Equities,” “Sustainability – Equities,” “Future Trends,” and “Global Technology,” allow users to capture investment opportunities in specific regions, industries, or themes. For example, the “Sustainability – Equities” model portfolio is made up of quality ESG (environmental, social, and governance) funds, and could appeal to investors who are interested in environmental issues or making a positive societal impact. However, it is essential to note that any concentrated investment in a single sector or region may increase the overall portfolio’s investment risk accordingly.

Alternative Investments

Professional investors (those with liquid assets of at least HK$8 million) on the Endowus platform can access institutional-grade alternative investment opportunities. Registered professional investors can invest in private equity, private credit, private real estate, hedge funds, and other products carefully selected by the Endowus investment research team. All these funds available on the Endowus platform are managed by the world’s top alternative investment management companies.

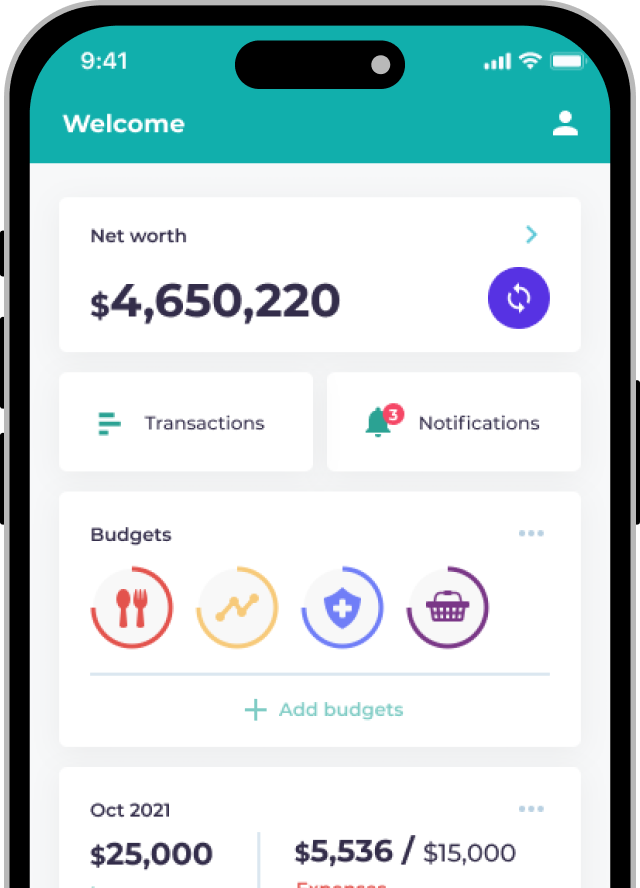

Online Account Opening as Fast as 10 Minutes

Endowus provides a smooth online account opening service. Hong Kong users can complete the account opening process on the website or app. Here are a few quick steps to do so:

- Register for an account with an email on the Endowus website or app, set a password, and complete phone number verification.

- Fill in personal information and complete an investment risk assessment.

- Upload identification documents such as an ID card or passport.

- Transfer HK$10,000 or more from a local bank account in compliance with the requirements of the SFC of Hong Kong to activate the account.

- Approval can be as quick as 1 business day, and applicants will receive an email notification upon successful application.

Endowus Fee

Endowus’ charges are clear and transparent, only charging an all-in Endowusfee, calculated based on the daily average asset value of investments held in the account, with an annual fee ranging from 0.1% to 0.6%.There are no subscription fees, platform fees, switching fees etc and they rebate 100% sales commission received from fund managers as Cashback to clients.

| Cash Management | Traditional Investment | Alternative Investment | |

| Single Fund | 0.10% | – Below HK$20 million: 0.40% – HK$20 million to HK$35 million: 0.35% – Above HK$35 million: 0.25% | – Below US$500,000: 0.60% – US$500,000 to US$1 million: 0.55% – US$1 million to US$3 million: 0.50% – US$3 million to US$5 million: 0.45% – Above US$5 million: 0.40% |

| Fund Portfolio | 0.10% | – Below HK$1 million: 0.60% – HK$1 million to HK$8 million: 0.50% – HK$8 million to HK$20 million: 0.40% – HK$20 million to HK$35 million: 0.35% – Above HK$35 million: 0.25% | – Below US$500,000: 0.60% – US$500,000 to US$1 million: 0.55% – US$1 million to US$3 million: 0.50% – US$3 million to US$5 million: 0.45% – Above US$5 million: 0.40% |

Who is Endowus Suitable for?

Endowus allows retail investors to subscribe to institutional-grade funds with as little as HK$10,000. Although it should be noted that institutional-grade funds do not guarantee no losses, the extremely low fund fees indeed significantly reduce the cost of investment.

Looking at the performance over the past year, Endowus has selected more than 200 funds, over 80% of which have recorded positive returns, with some funds having gains of more than 20%. The performance is quite impressive. Whether you are a beginner at investing, lack the time to analyze a large amount of information, or are a professional investor, you will most probably be able to find suitable and comprehensive fund products on Endowus. It allows you to choose and customise high-quality, multi-fund portfolios in the shortest time. As a platform for main investment funds, it is a trustworthy choice.

FAQ About Endowus

As per the requirements of the Hong Kong Securities and Futures Commission, customer funds and assets are stored separately from Endowus’s company assets. All of the client’s investments are stored in custodian accounts maintained by the respective transfer agents of each fund company (such as Fidelity, Invesco, etc.). Uninvested cash balances are stored in a separate client money account at HSBC in Hong Kong, which is regulated by the Hong Kong Monetary Authority.

To register as a professional investor, you simply need to submit proof to Endowus that you hold liquid assets worth HK$8 million for verification. The assets include investment market value (stocks, bonds, unit trusts, equity-linked investments, and other investment products), deposit certificates, and cash or cash equivalent deposits.